Rivian (NASDAQ:RIVN) continues to rack up significant losses, and there’s no obvious end in sight, with production expected to remain flat through 2024. What’s more, the company’s gross margin didn’t move in the right direction in 2023. So, with analyst estimates now suggesting that Rivian won’t reach breakeven until 2029, it seems hard to back this EV newcomer. As much as I’d like to see this company succeed, I’m bearish on Rivian, even as the stock has slid from a high of ~$179 to just over $10.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Things Aren’t Getting Much Better

For the year ending December 31, 2023, Rivian’s total revenue came in at $4.4 billion on the back of 50,122 vehicle deliveries. This was up from 20,332 vehicle deliveries in 2022 and $1.6 billion in revenue. However, the company remained loss-making — significantly so. In Fiscal Year 2023, Rivian generated a gross loss of $2 billion compared to $3.1 billion in 2022, and the 2023 net loss of $5.4 billion was an improvement on 2022’s $6.7 billion loss.

One area of concern is margins. Its gross margin was -46% in the fourth quarter of 2023, down from -36% in Q3 and -37% in Q2 2023. In the fourth quarter, this -46% margin equated to a $43,372 loss per vehicle delivered. That’s an exceptionally challenging position for any company to be in. Although it’s worth noting that the Q4 position was an improvement year-over-year, Rivian lost $124,162 per car delivered in Q4 of 2022.

While we can see some improvements, the company arguably isn’t moving in the right direction as quickly as many investors would have hoped, as is indicated more readily by Rivian’s forward projections. It’s certainly not the growth curve that Tesla (NASDAQ:TSLA) experienced.

The company has said it plans to reduce its workforce by 10% and, through this, hopes to achieve a modest gross profit by Q4 of 2024. However, this will have to be achieved without any significant economies of scale.

Rivian actually produced 57,232 vehicles in 2023, and it plans to produce 57,000 again in 2024. The firm highlighted economic and geopolitical uncertainties as well as the impact of historically high interest rates as part of its decision not to pursue a more aggressive strategy. The figure marks a slowdown from Q4 of 2023, when the run rate was closer to 70,000 vehicles per annum.

A host of companies in the NEV (new energy vehicle) space have recently indicated that demand isn’t as strong as it once was. And it seems that Rivian’s management is thinking the same, given its decision to keep production fixed for 2024. In fact, we’ve also seen the likes of Apple (NASDAQ:AAPL) and Ford (NYSE:F) remove themselves from the BEV (battery electric vehicle) space. While broad conditions don’t appear to be positive, it’s possible that Rivian could benefit from the market becoming less crowded.

RIVN’s Valuation Is Reasonable, But Risks Remain

Rivian is currently trading at 2.16x TTM sales and 2.01x forward sales. That’s not overly attractive — especially compared to its Chinese NEV peers — but it’s worth noting that Rivian ended the fourth quarter of 2023 with $9.4 billion in cash, cash equivalents, and short-term investments. Normally, I’d say that’s a strong position, but it’s a company losing money hand over fist. In fact, some forecasts suggest that the company could face a cash shortfall in H2 of 2025.

This is a real concern when considering that this EV newcomer may not break even until 2029. However, because of its net cash position, Rivian has a more attractive EV-to-sales ratio of 1.22x and a forward EV-to-sales ratio of 1.1x.

Given its cash-burn rate, Rivian may be forced to raise more capital or enter a net debt position as it moves toward profitability. There is clearly an element of risk here, and it requires investors to truly believe in the company’s route to profitability. Personally, I’m not convinced about Rivian, and I don’t think it has a strong USP (unique selling proposition). That’s an issue for a company that needs to scale, eventually, to become profitable.

The firm has shifted from its initial focus on trucks, moving on to SUVs and vans. While this may be a strategic move to widen its market, I’m not convinced it does anything for the brand as a whole. It also appears that its deal with Amazon (NASDAQ:AMZN) for the delivery of 100,000 vans isn’t going entirely to plan, with the e-commerce giant operating just a tenth of this number at the end of 2023.

Is Rivian Stock a Buy, According to Analysts?

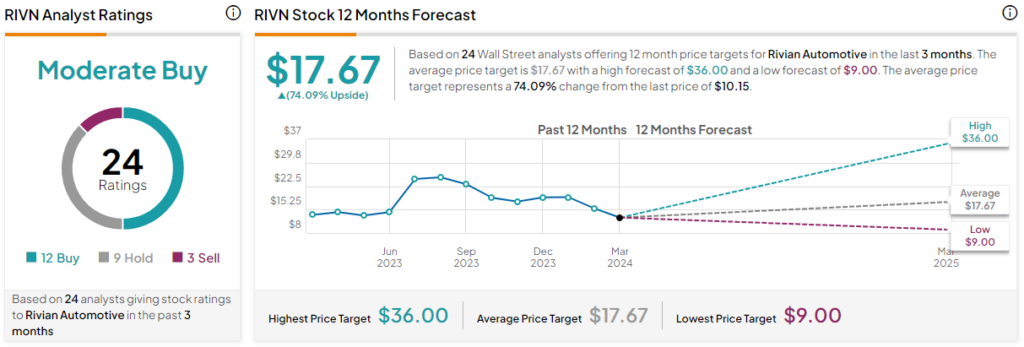

Rivian stock is a Moderate Buy, according to Wall Street analysts who have covered the company in the past three months. The stock has 12 Buy ratings, nine Hold ratings, and three Sell ratings. The average RIVN stock price target is $17.67, with a high forecast of $36.00 and a low forecast of $9.00. The average price target represents a 74.1% upside from here.

The Bottom Line on RIVN Stock

Rivian stock might not look very overvalued when we use the EV-to-sales ratio. But when we consider the company’s burn rate and its slow progress toward profitability, I’m concerned about Rivian’s future. While I’d love to see this EV firm make a success of itself, I’m struggling to see beyond its continuing losses and potential liquidity issues in 2025.