Shares of First Republic Bank (NYSE:FRC) plunged today, which can be attributed to a rating cut from S&P. Indeed, FRC was downgraded to Junk due to outflow risk, going from A- to BB+. This comes despite the additional funds secured from JPMorgan Chase and the Federal Reserve, which brought its liquidity up to $70 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, this isn’t the first downgrade either. Earlier in the week, multiple analysts also lowered their expectations, such as Bill Carache of Wolfe Research and David Long from Raymond James.

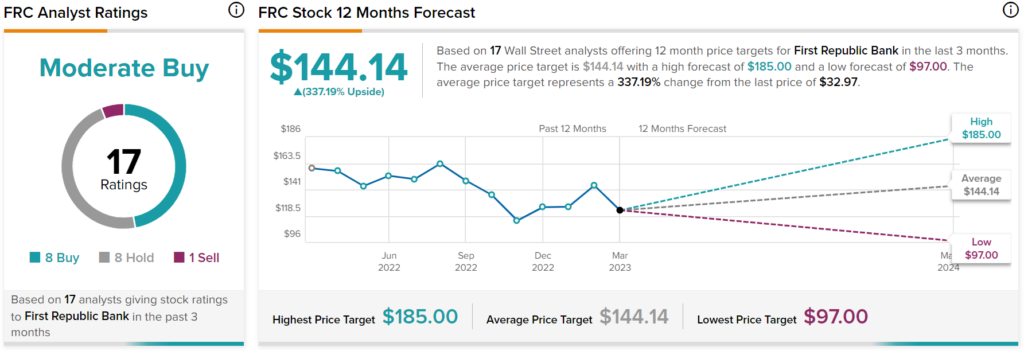

Nevertheless, Wall Street has an overall Moderate Buy consensus rating on FRC stock based on eight Buys, eight Holds, and one Sell assigned in the past three months. In addition, the average price target of $144.14 per share implies over 337% upside potential.