Fox News Media has parted ways with its top-rated host, Tucker Carlson, days after its parent company Fox Corporation (NASDAQ:FOXA, FOX) reached a $787.5 million settlement with Dominion Voting Systems in a defamation lawsuit that involved Carlson as well. FOXA shares fell nearly 3% on Monday in reaction to the news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dominion alleged that Fox’s news networks aired false claims about the voting machine company’s involvement in rigging the outcome of the 2020 U.S. presidential election in favor of Joe Biden. Carlson was expected to testify during the trial. Some of Carlson’s messages that were made public in the Dominion case revealed that Carlson criticized his colleagues and Fox’s management.

In one particular message, Carlson and his fellow prime-time hosts Laura Ingraham and Sean Hannity complained about Fox’s news coverage, especially the network’s decision to call the key state of Arizona for Biden on the night of the election. This moved had angered some loyal Fox News viewers and prompted certain Donald Trump supporters to switch to rival networks.

Carlson is being separately sued in a lawsuit filed by former Fox News staffer Abby Grossberg. The lawsuit alleges widespread discrimination at the network.

Drawing more than 3 million viewers to his show Tucker Carlson Tonight, Carlson is considered one of the most-watched U.S. TV personalities. Fox News issued a brief statement about Carlson’s departure, saying that they “have agreed to part ways.” Carlson’s last program was aired on Friday, April 21. The company said that it will air Fox News Tonight at 8 p.m. ET starting Monday evening as an interim show hosted by rotating Fox News personalities until a new host is chosen.

Is FOXA Stock a Buy, Sell, or Hold?

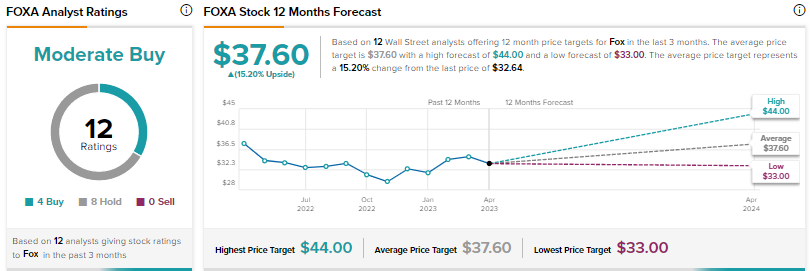

Wall Street is cautiously optimistic about FOXA stock, with a Moderate Buy consensus rating based on four Buys and eight Holds. The average price target of $37.60 implies 15.2% upside. Shares have advanced 7.5% year-to-date.