Shares of Fortinet (NASDAQ:FTNT) plunged over 24% in Friday’s pre-market trading, as the cybersecurity company reported mixed third-quarter results and issued a dismal fourth-quarter revenue outlook. Enterprises are optimizing their spending in an uncertain macro environment, impacting the demand for Fortinet’s products. FTNT stock was downgraded by four analysts (as of writing) following the weak results and guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the earnings call, management said that increased deal scrutiny and longer sales cycles are weighing on the company’s near-term performance.

Fortinet’s Mixed Results and Weak Outlook

Fortinet generated revenue of $1.33 billion in Q3 2024, reflecting a 16.1% year-over-year growth. The top line was driven by a 27.6% rise in the company’s Services revenue, partially offset by a 0.6% decline in Product revenue. Adjusted earnings per share (EPS) increased 24% to $0.41.

The company exceeded analysts’ Q3 adjusted EPS expectation of $0.36 but lagged revenue estimate of $1.35 billion. Fortinet’s Q3 billings, which grew 5.7% to $1.49 billion, also fell short of Wall Street’s expectation of $1.59 billion.

CEO Ken Xie stated that the Secure Networking market is witnessing slower growth, with product demand returning to normal levels following two years of elevated growth. In this scenario, the company is focusing on the rapidly growing Secure Access Service Edge (SASE) and Security Operations markets. Nonetheless, the CEO said that Secure networking remains an essential part of FTNT’s strategy, as the company believes that this market will return to double-digit annual growth over time.

Coming to the Q4 outlook, Fortinet expects revenue in the range of $1.38 billion to $1.44 billion, while analysts projected revenue of $1.50 billion. The company expects adjusted EPS of $0.42 to $0.44, compared to analysts’ estimate of $0.42. FTNT also lowered its full-year revenue outlook to $5.27 billion to $5.33 billion from its prior forecast of $5.35 billion to $5.45 billion. However, it raised its 2023 adjusted EPS guidance to the range of $1.54 to $1.56 from the previous outlook of $1.49 to $1.53.

Is FTNT a Good Buy Now?

Multiple analysts downgraded Fortinet stock following the poor performance. Analysts at Evercore, Stifel, and Cantor Fitzgerald downgraded the stock from Buy to Hold. Additionally, JPMorgan analyst Brian Essex downgraded Fortinet from Buy to Hold and slashed the price target to $52 from $67, citing unfavorable risk-reward.

Essex blamed the weak Q3 results on sales execution and softness in many verticals, including Service Provider and Retail. He added that the U.S. and European markets were weaker in the third quarter.

The analyst contended that visibility into a possible recovery in 2024 is limited due to macro headwinds and a change in the company’s go-to-market strategy, with the focus shifting toward SecOps and Universal SASE businesses.

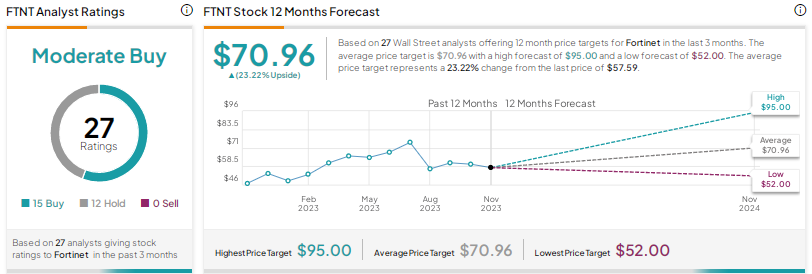

Overall, Wall Street is cautiously optimistic on Fortinet stock, with a Moderate Buy consensus rating based on 15 Buys and 12 Holds. The average price target of $70.96 implies 23.2% upside potential.