Restaurant Brands International (TSE:QSR)(NYSE:QSR), which owns various fast-food brands, saw its stock close about 7% higher today following the news that former Domino’s Pizza (NYSE:DPZ) CEO Patrick Doyle will be joining the QSR team as executive chairman. The move is making investors optimistic, as Doyle has a great track record of success, and it’s very possible that QSR can become the next DPZ in terms of performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to Doyle’s LinkedIn profile, he started at DPZ in August 1997, where he “was President of the U.S. business, ran corporate stores, ran the International business, and began at the company as SVP of marketing.” He became the CEO in the first quarter of 2010 and stayed in that role until June 2018. Impressively, he “generated shareholder returns in excess of 2,100% and returned $3.4 billion to shareholders.” While he was at Domino’s, the company doubled its market share, becoming the highest-selling global pizza chain. These reasons are why Doyle joining the QSR team is being viewed positively.

While Restaurant Brands is not necessarily a bad company, as it has positive earnings and cash flow, its stock has only returned about 11% in the past five years (in Canadian dollars), even when including dividends. Therefore, the addition of Patrick Doyle can help boost shareholder returns.

What Companies are Part of QSR Stock?

QSR owns four restaurant chains: Burger King, Popeyes Louisiana Kitchen, Tim Hortons, and Firehouse Subs, which the company acquired last year for $1 billion. In Q3, 63.9% of Restaurant Brands’ system-wide sales came from Burger King, with the next biggest one being Tim Hortons at 18.6%. Popeyes contributed nearly 14.7% to system-wide sales, and the remaining ~2.8% came from Firehouse Subs.

Is QSR Stock a Buy, According to Analysts?

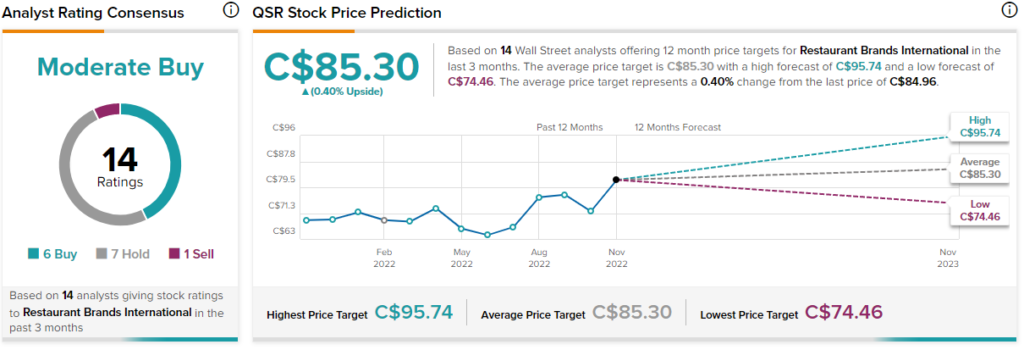

Analysts currently have a Moderate Buy consensus rating on QSR stock based on six Buys, seven Holds, and one Sell rating assigned in the past three months. The average QSR stock price target of C$85.30 implies just 0.4% upside potential. Nonetheless, the stock offers a 3.6% dividend yield that is well covered, as the company’s free cash flow payout ratio is 67%.

Conclusion: QSR Stock Can be the Next Domino’s

If you believe in the brands mentioned above and believe in Patrick Doyle’s ability to create value for the company, then QSR may be the right stock for you. With its 3.6% dividend yield and modest growth potential (its revenue grew by over 15% in Q3), QSR could be the next DPZ stock in terms of outperforming the market. Still, it’s likely wise to wait for a pullback before buying into QSR, as it has been rallying almost non-stop for over one month.