Earnings and revenue for Michigan-based Ford Motor Co. (F) exceeded expectations for Q3 2021, and the company’s shares surged 8.8% during after-hours trading on Wednesday to end the day at $16.87.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings per share (EPS) declined $0.14 year-over-year to $0.51 but remained higher than the Street’s estimate of $0.27.

Adjusted earnings before interest and taxes (EBIT) reached $3 billion, down 0.7% from the previous year. (See Insiders’ Hot Stocks on TipRanks)

Similarly, revenue fell 5% year-over-year to $35.7 billion, although it exceeded analysts’ expectations of $33.11 billion. Meanwhile, Automotive revenue decreased 4% to $33.2 billion.

Ford CFO, John Lawler, said, “The company expects to invest $40 billion to $45 billion in strategic capital expenditures between 2020 and 2025 – including one-half of the more than $30 billion will be devoted exclusively to Battery Electric Vehicles (BEVs) during that same period.”

“What’s certain is that we’re going to keep investing smartly and heavily in Ford+ – customer-facing technology and always-on relationships, connectivity, and Electric Vehicles (EVs) – on top of a foundation that’s broad and deep. We believe the long-term value creation from these investments will be substantial,” Lawler added

Notably, the company has raised the adjusted EBIT guidance for 2021 to between $10.5 billion and $11.5 billion.

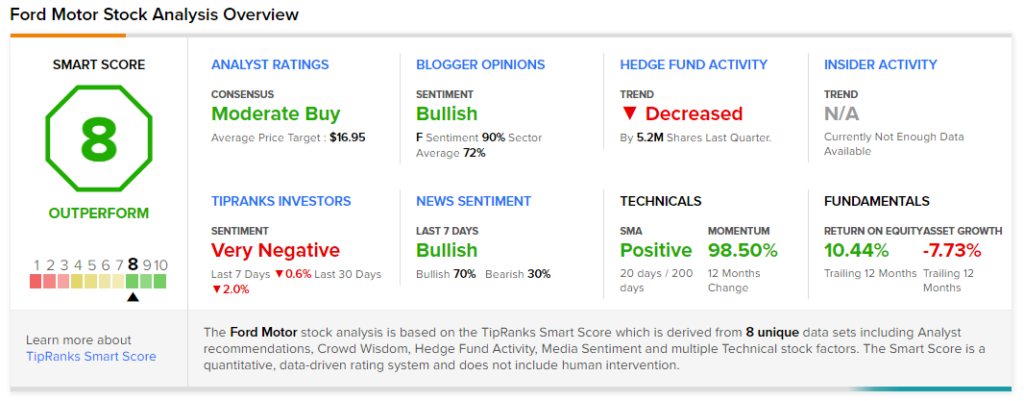

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys, 4 Holds and 1 Sell. The average Ford Motor price target of $16.95 implies 9.3% upside potential. Shares have gained 101.4% over the past year.

According to TipRanks’ Smart Score rating system, Ford scores an 8 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Boeing Reports Wider-than-Expected Q3 Loss

ATD Gives BEST Award to BMO

McDonald’s Soars 3.2% on Solid Q3 Results

5 Top Dividend Stocks for November 2021