Automotive major Ford (NYSE:F) intends to slash the planned production of its F-150 Lightning pickup by nearly half in 2024, according to CNBC.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reportedly, beginning in January, about 1,600 F-150 Lightning pickups will be produced at the company’s EV facility in Dearborn, Michigan. This development comes after Ford ramped up its EV capacity this year.

The production cuts come as automakers adjust to the present market environment of tepid customer demand. As prices and elevated interest rates impact buying patterns, auto companies are taking a relook at their production and investment plans.

Earlier, Ford scaled back its $3.5 billion investment plans in Michigan, slashing production capacity to 20 GWH per year. Amid sagging Jeep sales and stringent emission regulations, Stellantis (NYSE:STLA) is also temporarily cutting a shift at one of its Detroit plants and slashing positions at its Toledo plant. Anticipating a decline in gas-powered vehicles, the company is also slashing Jeep production.

Despite these challenges, Ford is moving to expand its EV solutions. The company recently teamed up with Resideo Technologies (NYSE:REZI) on a joint simulation project for vehicle-to-home (V2H) energy management. It is also collaborating with Xcel Energy (NASDAQ:XEL) for the deployment of 30,000 electric vehicle charging ports in the U.S. by 2030.

Is F Stock a Good Long-term Investment?

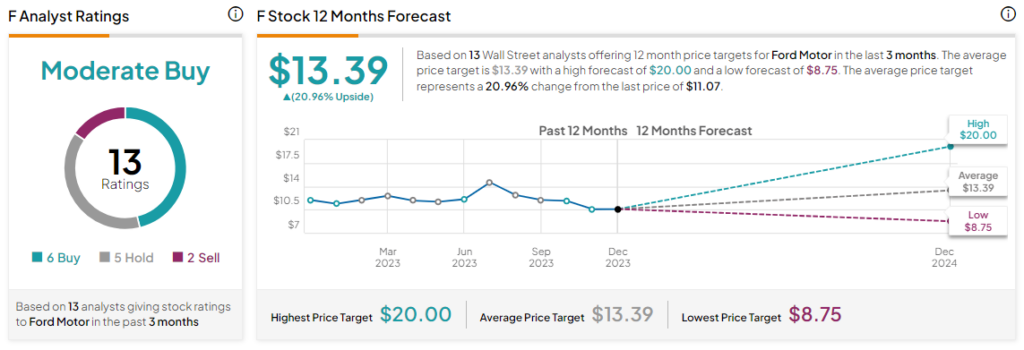

Overall, the Street has a Moderate Buy consensus rating on Ford, and the average F price target of $13.39 points to a nearly 21% potential upside in the stock. That’s on top of a nearly 13% rise in the company’s share price over the past month.

Read full Disclosure