Remember when legacy automaker Ford (F) was warning customers about using the Tesla (TSLA) Supercharger adapter on their electric vehicles? Well, Ford just took a big step toward fixing that permanently, by offering its own version that it will give out free. The news proved little help, though, as shares were down nearly 2% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A report in The Verge revealed that Ford is bringing out its own adapter for Ford vehicles to use the Tesla Supercharger network. The adapters are being made by Lectron, a company that already makes the Vortex charger, which is basically a Ford-to-Tesla adapter. But Lectron actually had to recall its line of adapters earlier, as they had an unexpected defect that could cause the charger to become unlatched while it was charging a vehicle.

Lectron ultimately fixed the flaw that caused the unexpected decoupling, and the new adapters—according to Ford’s press representatives—have no connection to the original adapters that Ford told its customers to stop using. While other electric vehicle makers, including General Motors (GM), offer adapters to use the Tesla Supercharger network, Ford was the first to allow that access with free adapters. GM charges $225 for its adapter.

Ford’s Loss, Peloton’s Gain

Meanwhile, Ford just lost a significant player in its operation, as its president of digital services, Peter Stern, has departed the company to be the new CEO of Peloton (PTON). The beleaguered exercise equipment maker may have picked up a real winner, as it has been increasingly focused on providing digital services to keep customers using its exercise equipment and paying for access. This is exactly what Stern was doing for Ford and previously at Apple (AAPL).

But Ford, meanwhile, loses one of its key architects of post-purchase services. Stern had been working to bring together services with hardware in segments like Ford Pro and Ford Blue, both of which have been seen as excellent profit drivers for the firm.

Is Ford Stock a Good Buy Right Now?

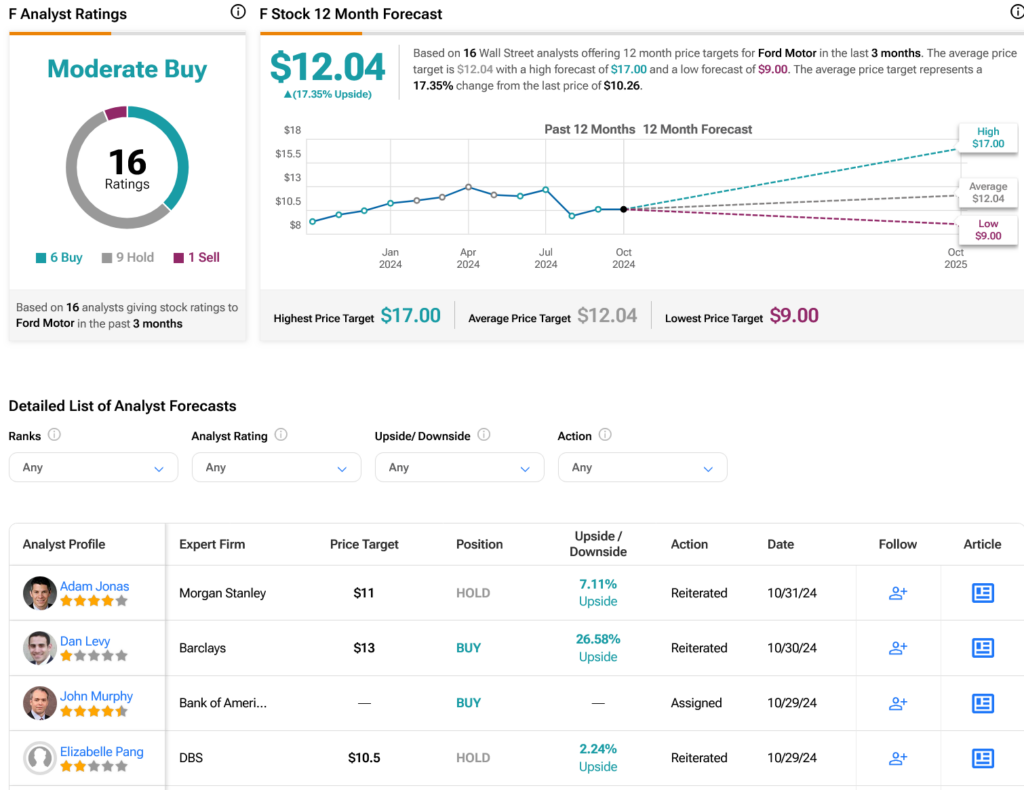

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on six Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 9.37% rally in its share price over the past year, the average F price target of $12.04 per share implies 17.35% upside potential.