Shares of footwear and apparel products provider Foot Locker (NYSE:FL) are rising today after the company posted better-than-estimated numbers for the fourth quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenue remained largely unchanged at $2.33 billion but came in ahead of expectations by $190 million. EPS at $0.97 too outpaced estimates by a robust $0.46. During the quarter, comparable-store sales rose by 4.2% on the back of higher traffic and better inventory access.

Further, FL had a cash pile of $536 million at the end of Q4 and operated 2,714 stores across 29 countries.

Looking ahead, for 2023, the company expects sales to decline in the range of 3.5% and 5.5%. EPS is expected to land between $3.35 and $3.65.

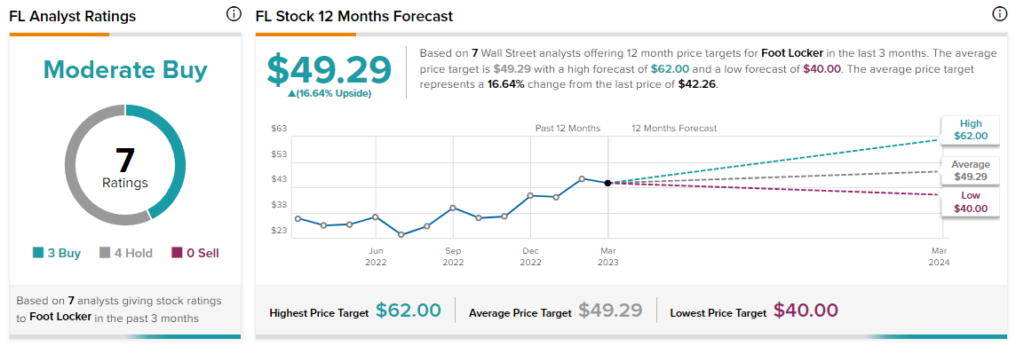

Overall, Wall Street has a consensus price target of $49.29 on FL, implying a 16.6% potential upside in the stock. That’s on top of a 14% gain in FL shares so far this year.

Read full Disclosure