Athletic shoes and clothing retailer Foot Locker (NYSE:FL) slid in trading on Thursday after top-rated Goldman Sachs analyst Kate McShane downgraded the stock from Hold to Sell, citing concerns over the ongoing repositioning of the Champs Sports brand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analyst expressed apprehension that this transformation might continue to impact Foot Locker’s comparable sales negatively. The company is striving to distinguish the Champs brand from Foot Locker to drive additional customers in its Fitness and Lifestyle categories for products under $100. As a part of this transition, the company plans to close around 125 underperforming stores in FY23 to focus on strong geographic markets.

However, according to McShane, the change may risk losing existing customers, making it challenging for Foot Locker to stabilize its market position, especially after Nike’s allocation adjustments. The analyst has a price target of $18 for the stock, implying a downside risk of 17.3% from current levels.

Is FL a Good Stock to Buy?

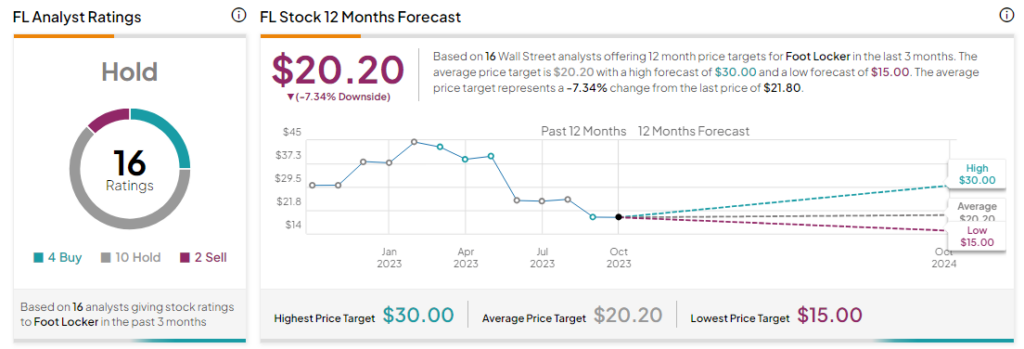

Analysts are sidelined about FL stock with a Hold consensus rating based on four Buys, 10 Holds, and two Sells. The average FL price target of $20.20 implies a downside risk of 7.34% from current levels.