It was a disaster of a day for FMC Corporation (NYSE:FMC), as it dove in Monday afternoon’s trading and, at one point, hit a low it hadn’t seen in over 20 months. The losses were so steep that they generated a negative halo effect, hitting other agricultural operations in the process.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As it turns out, the massive hit FMC took could be traced back to one key point: a cut in guidance. Not so much a “cut,” however, as an outright dismemberment. It was bad enough that FMC’s guidance was disappointing back when it was originally released. Its second-quarter earnings and revenue figures were already below what analysts were expecting. But the cuts that followed made a bad situation far, far worse. FMC guidance for the second quarter started out between $1.42 billion and $1.48 billion. With analysts expecting $1.45 billion, that wasn’t good news, but it was reasonable. Now, FMC expects revenue between $1 billion and $1.03 billion, which is a calamity.

Supply chain issues seem to be driving the cuts, with one major strike at the Port of Vancouver threatening to be a big problem for potash fertilizer stocks. Further, starting back in the late days of May, FMC noted “…abrupt and unprecedented reductions in channel inventory” across several of its key operating locations, from North America to the Europe, Middle East, and Africa (EMEA) regions. Certainly, farmers still have a clear interest in chemical fertilizer, but getting it to them will prove an ongoing challenge.

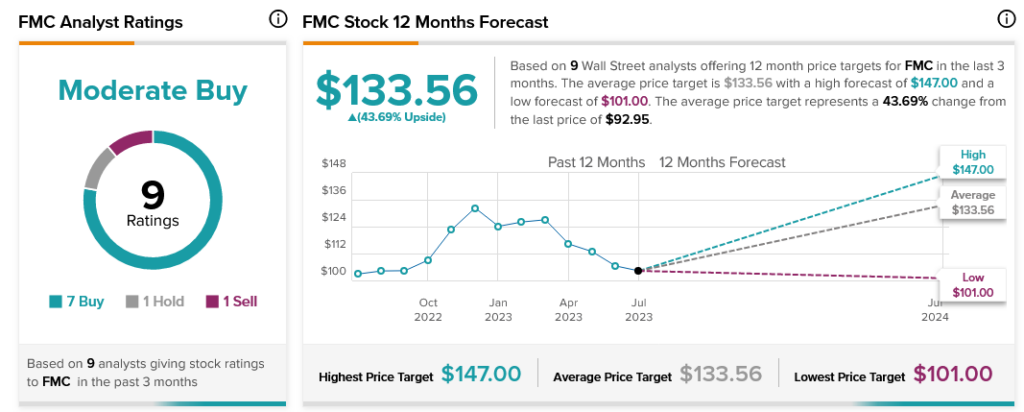

Despite this, however, analysts are still very much on FMC’s side. With seven Buy ratings, one Hold, and one Sell, FMC stock is considered a Moderate Buy by analysts. Further, with an average price target of $133.56, FMC stock also offers investors 43.69% upside potential.