Shares of American specialty discount chain Five Below, Inc. (FIVE) fell 9.3% in the extended trading session on September 1 after the company delivered mixed second-quarter results. During the quarter, FIVE opened 34 new stores across 19 states, ending the quarter with 1,121 stores across 39 states.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the second quarter, the company posted earnings of $1.15 per share, up 117% year-over-year, and outpaced analysts’ estimates of $1.11 million. (See Five Below stock charts on TipRanks)

Moreover, net sales climbed 51.7% to $646.55 million compared to the year-ago period but fell short of the Street’s estimate of $646.9 million. Also, comparable sales grew 39.2% compared to the prior-year period.

Believing the third quarter is off to a strong start from a sales perspective, Joel Anderson, President, and CEO of the company said, “We are confident that our Wow assortment, the flexibility of our unique model with eight worlds and our new Five Beyond offering, combined with the operating discipline of our teams across the organization, will continue to serve us well as we drive sustainable long-term growth and realize our 2,500-plus store potential in the U.S.”

For the third quarter, FIVE forecasts net sales and earnings to fall in the range of $550 – $565 million and $0.23 – $0.30 per share, respectively. The consensus estimates for revenue and earnings are pegged at $549.08 million and $0.24 per share, respectively.

In response to the quarterly performance, Berenberg Bank analyst Brian McNamara maintained a Hold rating on the stock with a price target of $185, implying 14.4% downside potential to current levels.

McNamara said, “Despite a Q3 comp better than we expected and likely aided by the child tax credit, there remains considerable uncertainty as to how the cycling of difficult comps in Q4 will play out as external tailwinds fade, in our view. Value retailer stocks have had a difficult Q2 earnings season and FIVE appears to be no different.”

The analyst noted that FIVE’s merchandise are low-ticket items and are almost all discretionary in nature, which could pressure results in uncertain macroeconomic times.

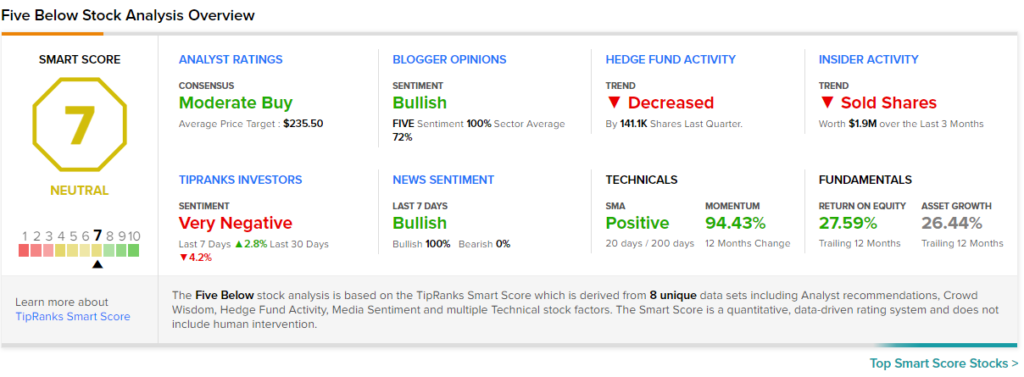

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 6 Holds. The average Five Below price target of $235.50 implies 9% upside potential to current levels. Shares have gained 84.5% over the past year.

Also, according to TipRanks’ Smart Score system, Five Below gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

CrowdStrike Dips 5% Despite Exceeding Q2 Expectations & Lifting Guidance

Anaplan Q2 Results Impress; Shares Surge 15% After-Hours

PVH Exceeds Q2 Expectations, Lifts Guidance; Shares Jump 7% After-Hours