Fisker Inc. (FSR), an EV manufacturer, inked a product and service agreement with the software company ServiceNow (NOW). Per the terms of the deal, Fisker will buy ServiceNow’s IT Service Management (ITSM) Pro and Software Asset Management (SAM) solutions for its employees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Through ServiceNow’s digital workflows, Fisker plans to create frictionless experiences for its employees. The product will allow them to spend less time on non-critical tasks so that more time can be devoted to building EVs.

According to Fisker, ServiceNow’s ITSM Pro solution will be used to deliver scalable services, augment productivity and create resilient IT service experiences for its employees. The company’s SAM solution will be used to optimize IT productivity, cost, and resilience, enabling employees to work faster and smarter.

Fisker CEO Henrik Fisker commented, “Our ability to hit our quality, cost and delivery targets is heavily dependent on the software, infrastructure and tools we give to our employees. We have set up our company to operate lean and fast. Partnering with ServiceNow will help us deliver against those targets.” (See Fisker stock analysis on TipRanks)

The production and delivery of the company’s first vehicle, the Ocean electric SUV, is expected to start in November 17, 2022. At the beginning, Fisker will manufacture the vehicle in Europe and sell it across multiple markets in Europe and North America.

On May 18, R.F. Lafferty analyst Jaime Perez decreased the stock’s price target to $19 (51.9% upside potential) from $24 and maintained a Buy rating.

Perez commented, “The company is making progress towards its production and delivery forecast of the Fisker Ocean in the fourth quarter of 2022 with its contract manufacture Magna (MGA). The Ocean begins its next evolution as the company commences supplier sourcing, production tooling, and building prototypes. In addition, the company increased its employee headcount to 203, double from year-end 2020 as it prepares for product launches.”

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating. That’s based on 5 Buys, 3 Holds, and 1 Sell. The average analyst price target of $25.25 implies 101.8% upside potential to current levels. Shares have increased 22.2% over the past year.

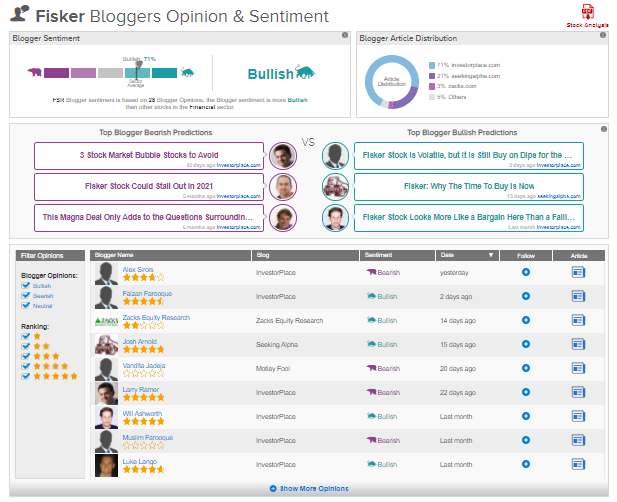

TipRanks data shows that financial blogger opinions are 71% Bullish on FSR, compared to a sector average of 69%.

Related News:

Cabot and Cimarex Ink All-Stock Merger Deal; Shares Fall

BioMarin Gets EMA Permit for Accelerated Assessment of Valoctocogene Roxaparvovec

Lennox Bumps Up Quarterly Dividend By 19%