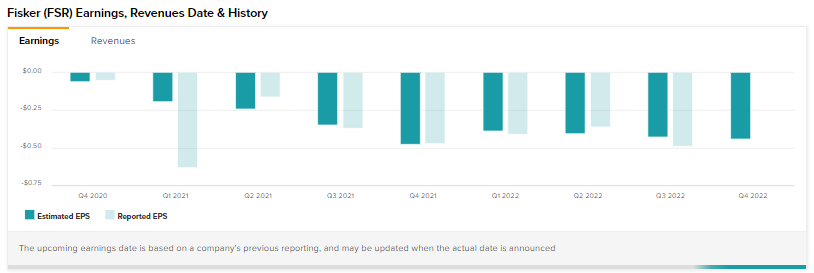

Shares of EV maker Fisker (NYSE:FSR) are tanking today after the company drove in a disappointing third-quarter performance with net loss per share at $0.49 coming in wider than expectations by $0.07.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company now expects to start production of Fisker Ocean on November 17. It plans to increase production from 300+ in the first quarter of 2023 to 15000+ in Q3 and reach 42,400 units in Q4.

Further, it had 62,000 net reservations for Fisker Ocean as of October 31. The company plans to start accepting orders for the Fisker Ocean extreme by mid-January 2023.

Fisker had a cash pile of $824.7 million at the end of September. For the full-year 2022, the company expects to incur total operating expenses between $435 million and $500 million. Capital expenditure is expected to hover between $280 million and $290 million.

Additionally, RBC Capital’s Joseph Spak lowered the rating on Fisker to a Hold from a Buy today while also slashing the price target to $8 from $13.

The analyst sees short-term execution risk for the stock and feels sales could be lower “in the outer years” as Fisker’s offering could be less competitive owing to the Inflation reduction Act.

Read full Disclosure