Fisker (NYSE:FSR) shares surged nearly 7% in the early session today after the EV producer filed its quarterly report. This comes after receiving a notice of non-compliance from the NYSE for failing to file its quarterly report in a timely manner.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s shares have tanked by nearly 60% over the past month after it postponed its third-quarter results due to the departure of its Chief Accounting Officer earlier this month.

Subsequently, the firm posted a dismal performance for the quarter, with revenue of $71.8 million falling well short of the Street’s expectations of $143.1 million. Recently, Fisker lowered prices for the Ocean Extreme model in the U.S. and Canada and is expanding its delivery infrastructure.

Still, possible questions remain for investors as Fisker lost its second Chief Accounting Officer this month only a day after reporting its third-quarter numbers, according to the Wall Street Journal.

Is FSR Stock a Good Investment?

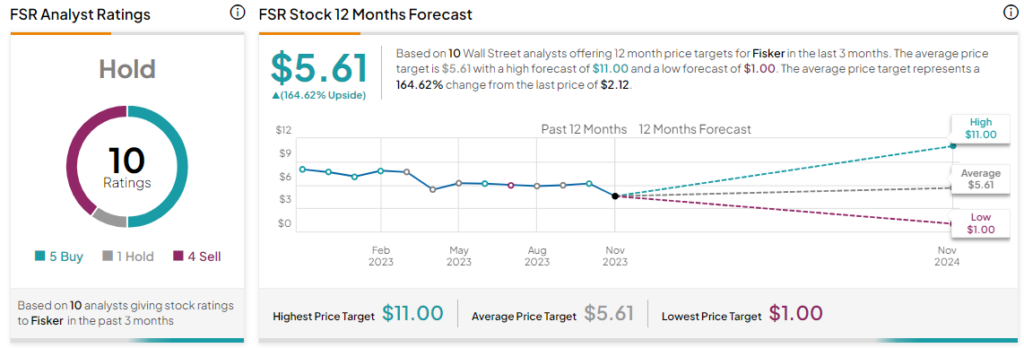

Amid these challenges, Goldman Sachs’ Mark Delaney recently reiterated a Sell rating on Fisker while lowering the price target to $2 from $8. Overall, the Street has a Hold consensus rating on Fisker and the average FSR price target of $5.61 implies a substantial 164.6% potential upside in the stock.

Read full Disclosure