EV maker Fisker (NYSE:FSR) has entered into an agreement with EV pioneer Tesla (NASDAQ:TSLA) to offer its customers access to the latter’s supercharger network, meaning additional charging options for Fisker’s customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The North American Charging Standard (NACS) will be available to Fisker vehicles in 2025. Importantly, all of Fisker’s current as well as future vehicles will be covered under this agreement. The supercharger network offers an impressive 12,000 supercharger stations across the U.S. and Canada.

In another development, Tesla has introduced cheaper versions of its Model S and X vehicles. The company has introduced the versions, which are priced nearly $10,000 lower than standard versions, in a bid to turbocharge demand.

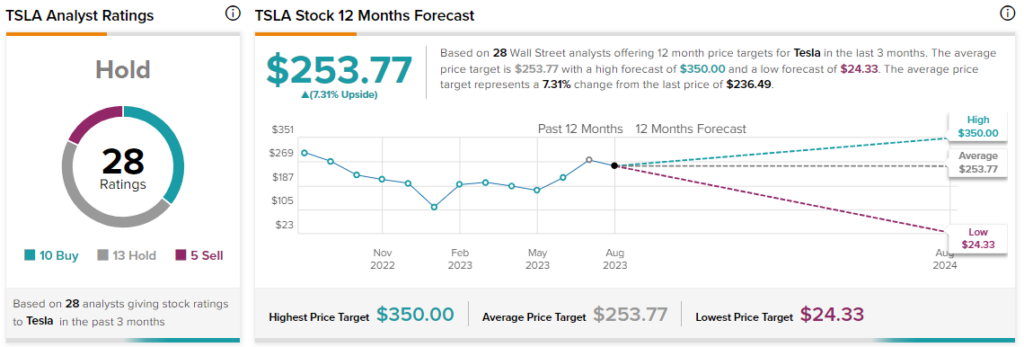

While the consensus rating on the Street remains a Hold for Tesla alongside a $253.77 consensus price target, Hargreaves Lansdown’s Susannah Streeter noted that the price cuts come as the company looks to overcome a tepid sales pattern in a challenging macroeconomic backdrop and amid heating competition.

Importantly, the cheaper vehicle introductions come fresh on the heels of Tesla lowering Model Y prices in China. While Tesla shares are down nearly 1.2% at the time of writing, Fisker shares are inching marginally higher today.

Read full Disclosure