Fiserv (NYSE:FI) shares are on the rise today after the financial services provider provided a healthy preliminary outlook for 2024 at its Investor Day event.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company expects organic revenue growth to be between 11% and 13% for Fiscal Year 2024. Meanwhile, adjusted EPS is expected to rise by 13% to 17% over 2023’s figure. Further, the company expects organic revenue growth of 9% to 12% annually in the medium term (years 2025 and 2026). Adjusted EPS is anticipated to rise by 14% to 18% during this time horizon.

Additional details regarding the company’s strategic and growth plans spanning the next several years are anticipated at its Investor Conference today.

Last month, Fiserv delivered a robust third-quarter performance with a nearly 8% growth in its top line. The quarter was marked by growth across Fiserv’s Acceptance, Fintech, and Payments segments.

Additionally, its operating margin ballooned to 30.8% from 18.9% in the comparable year-ago period. At the time, the company raised its outlook for Fiscal Year 2023, anticipating organic revenue growth of 11% and an adjusted EPS range of $7.47 to $7.52. This equates to adjusted EPS growth of between 15% and 16%.

Will Fiserv Stock Go Up?

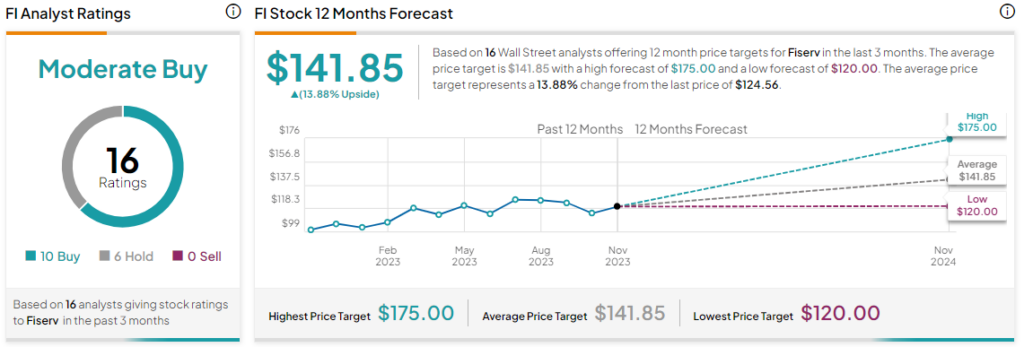

Overall, the Street has a Moderate Buy consensus rating on Fiserv. The average FI price target of $141.85 implies a nearly 13.9% potential upside in the stock.

Read full Disclosure