Shares of financial services provider Fiserv (NYSE:FI) have surged nearly 4% in the morning session today after its third-quarter EPS of $1.96 landed past expectations by $0.03. In tandem, revenue of $4.87 billion outperformed estimates by $270 million, reflecting a year-over-year growth of 7.7%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The quarter was marked by growth across Fiserv’s Acceptance, Fintech, and Payments segments. Moreover, its operating margin ballooned to 30.8% from 18.9% in the comparable year-ago period. The company generated $2.72 billion in free cash flow during the first nine months of the year. In addition, it acquired the remaining 49% stake in Netherlands-based European Merchant Services B.V. in September.

Buoyed by this robust performance, the company has raised its outlook for Fiscal Year 2023. It now expects organic revenue to rise by 11% for the year, up from the previous expectations of 9% to 11% growth. The adjusted EPS for the year is anticipated to hover in the range of $7.47 to $7.52 versus the previous outlook of $7.40 to $7.50. This points to an adjusted EPS growth between 15% and 16%.

Will Fiserv Stock Go Up?

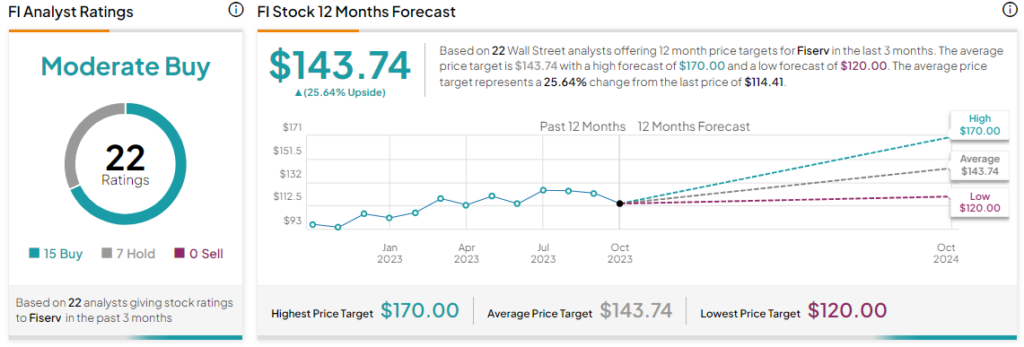

Overall, the Street has a Moderate Buy consensus rating on Fiserv. The average FI price target of $143.74 implies a 25.6% potential upside. With today’s price gain, shares of the company have jumped nearly 12.6% over the past year.

Read full Disclosure