The Federal Reserve’s recent interest rate cut and the expectations of further rate cuts have revived investor expectations about fintech stocks, which generally gain from a low-interest-rate backdrop. Analysts at Bernstein highlighted the attractiveness of the sector, which they believe offers lucrative stock picking opportunities. Bernstein named three companies – Fiserv (FI), Block (XYZ), and Adyen (ADYEY), which it believes stand out and are the fintech stocks to watch if the sector starts recovering.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While Bernstein has lower volume expectations in the U.S., it sees significant scope for growth in value-added services (VAS) across several companies.

Is Fiserv a Good Stock to Buy Now?

Fiserv stock is down about 36% year-to-date due to concerns about the slowdown in the growth of the company’s merchant solutions business, which includes the Clover point-of-sale payment processing system. The company’s merchant business is facing stiff competition from rivals like Block and Shift4 Payments (FOUR).

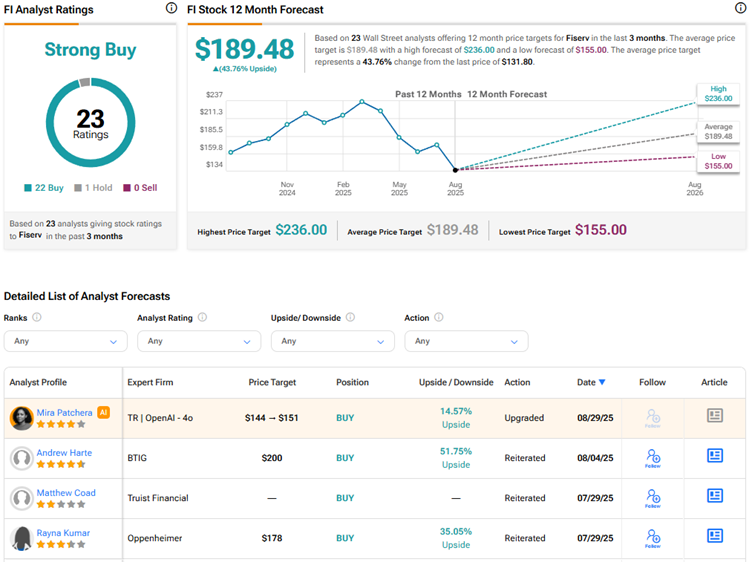

Bernstein stated that it is closely watching the guidance reset and a potential return to beat-and-raises for Fiserv, which is viewed as an “EPS grower.” The investment firm contended that while the Q2 miss was disappointing, Fiserv remains a high-quality name in the payments space and has “multi-faceted” growth drivers.

Trading at a P/E (price/earnings) multiple of 11.5x, Bernstein believes that FI stock has better asset and earnings quality as well as capital allocation compared to peers. That said, the firm cautioned that “the stock indeed will be in the penalty box for a while.”

Currently, Wall Street has a Strong Buy consensus rating on Fiserv stock based on 22 Buys and one Hold recommendation. The average FI stock price target of $189.48 indicates about 44% upside potential from current levels.

What Is the Price Target for Block Stock?

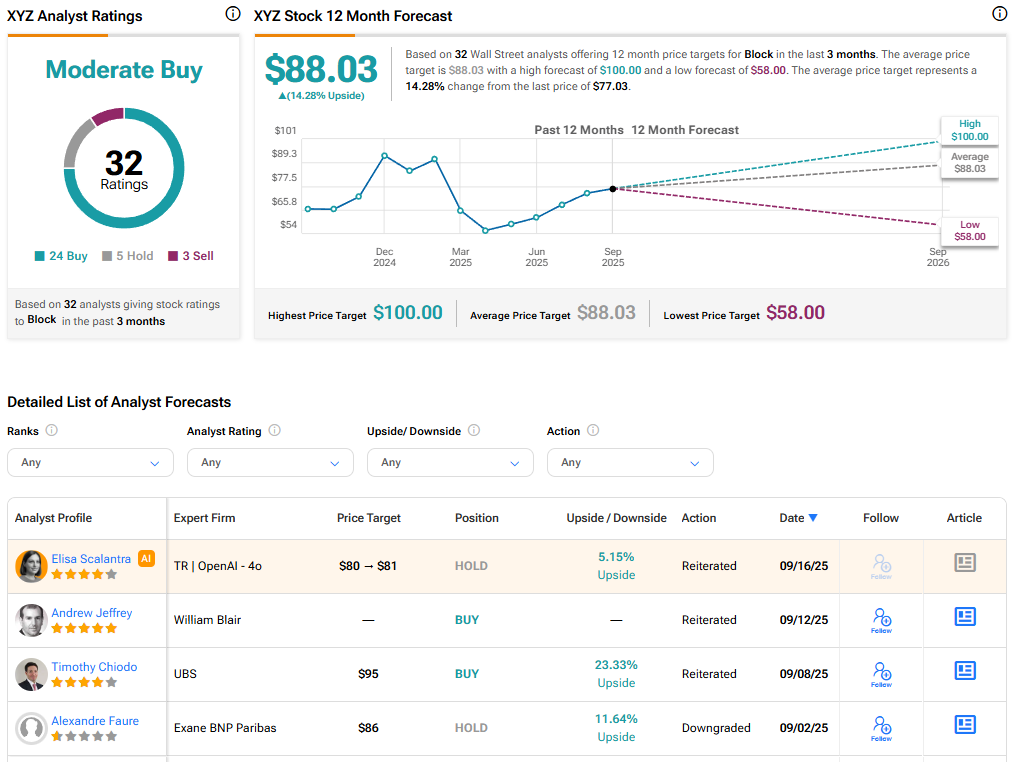

Block stock is down 9.4% year-to-date due to macro uncertainties and intense competition. The company delivered better-than-expected Q2 earnings despite ongoing challenges. Bernstein sees a “clear path” to accelerating metrics in the second half of the year. However, the investment firm cautioned about Block’s sensitivity to lower-income consumers.

Nonetheless, Bernstein views Block as a catalyst-rich name in its coverage into the second half, as he sees potential for improving numbers, including Square GPV (gross payment volume) acceleration and Cash App MAU (monthly active users) growth. Furthermore, Bernstein believes that at a P/E multiple of 24x (2026 GAAP earnings estimate), XYZ stock’s valuation is “undemanding.”

Bernstein expects a two percentage points of acceleration in Square GPV in the second half based on three reasons – improved go-to-market investments with stable payback, recent product enhancements like single app and better onboarding flow, and the development of new distribution abilities.

Currently, Wall Street has a Moderate Buy consensus rating on Block stock based on 24 Buys, five Holds, and three Sell recommendations. The average XYZ stock price target of $88.03 indicates 14.3% upside potential.

Is Adyen Stock a Buy?

Coming to payment firm Adyen, Bernstein contends that while idiosyncratic drivers and customer growth have made the company’s numbers a bit “lumpy,” debates about the reduced outlook after the new de-minimis regulations are misguided. Analysts at Bernstein do not expect macroeconomic factors to impact Adyen’s share gains.

Bernstein views Adyen’s ability to provide an “effective, integrated, and agile” payment solution as a competitive advantage. At a P/E multiple of 29x, Bernstein finds ADYEY stock to be trading at a very compelling entry point, which he views as a “rare quality compounder.”

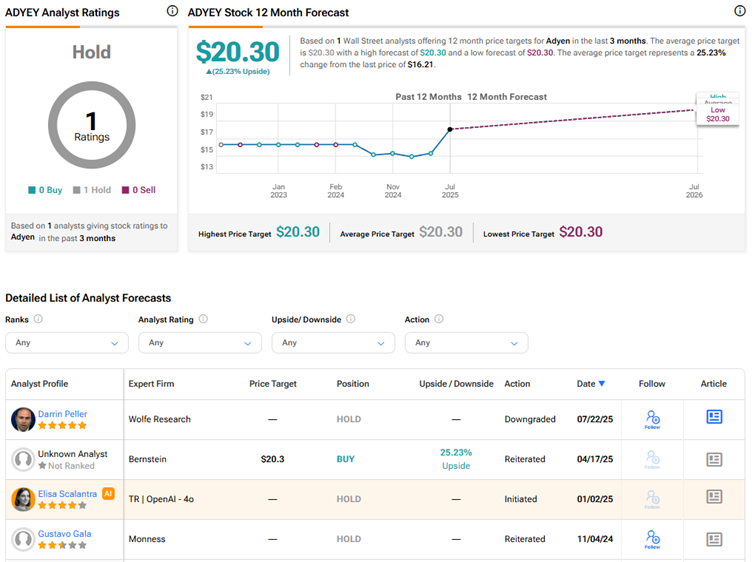

Currently, Wall Street is sidelined on Adyen stock, with the average price target of $20.30 indicating 25.2% upside potential.