First Republic Bank (FRC), a provider of private banking, private business banking, and private wealth management services, reported better-than-expected third-quarter results backed by steady growth in assets across all of its segments as well as excellent credit quality. Shares jumped 2.1% on the news, closing at $204.85 on October 13.

The bank reported earnings of $1.91 per share, up 18.6% year-over-year, and meaningfully outpaced analyst estimates of $1.84 per share.

Furthermore, revenue climbed 30.1% compared to the year-ago period to $1.3 billion and surpassed the Street’s estimate of $1.27 billion. Net Interest Income grew 26.7% year-over-year to $1.1 billion, driven by growth in average interest-earning assets.

During the quarter, the bank’s loan originations grew to $15.5 billion and the net interest margin was 2.65%. Also, the bank’s non-performing assets were very low at 7 basis points of total assets.

Additionally, the bank declared a quarterly cash dividend of $0.22 per common share payable on November 12 to shareholders of record on October 28. (See Insiders’ Hot Stocks on TipRanks)

Commenting on the results, Jim Herbert, Founder, Chairman, and Co-CEO of FRC, said, “First Republic had another strong quarter of growth in loans, deposits and wealth management assets. Our client-centric business model continues to perform very well across all our segments and markets.”

In response to FRC’s financial performance, Wedbush analyst David Chiaverini maintained a Buy rating on the stock while lowering the price target to $235 (14.7% upside potential) from $320.

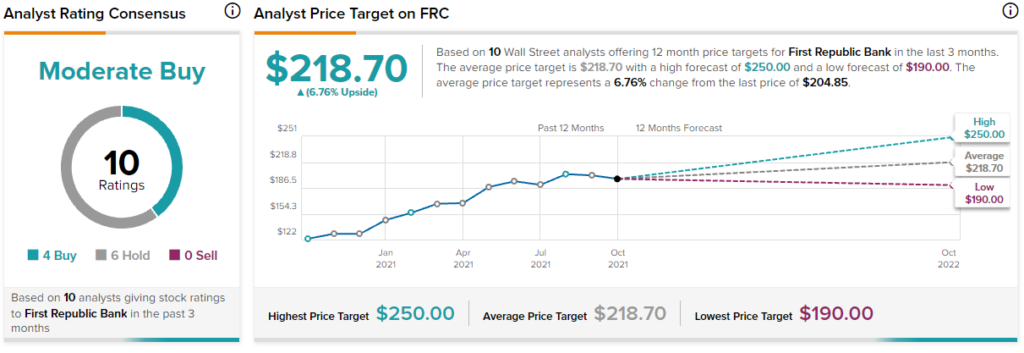

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 6 Holds. The average First Republic Bank price target of $218.70 implies 6.8% upside potential to current levels. Shares have gained 69.1% over the past year.

Related News:

IBM Board Approves Kyndryl Separation

Boeing Announces Q3 Jet Deliveries; Shares Fall

International Paper Increases Share Buyback Program by 2B, Slashes Quarterly Dividend