First Brands’ collapse has sent tremors through private credit markets, with the Ohio-based auto parts maker filing for Chapter 11 and disclosing more than $10bn in liabilities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It Was a Sudden Collapse

The company, owned by Malaysian-born businessman Patrick James, makes Carter fuel pumps in the US and Michelin-branded (MGDDF) windshield wipers in Europe. It filed late Sunday in the Southern District of Texas, listing liabilities between $10bn and $50bn against assets of just $1bn to $10bn.

The speed of the downfall has rattled debt investors. Just two weeks ago, its loans were trading at levels that suggested relative calm. By Friday, senior debt was changing hands at a third of its face value, while junior loans had collapsed to cents on the dollar.

“This is a case of debt getting ahead of reality,” one analyst said, pointing to billions in opaque off-balance sheet financing that will now come under investigation by a special bankruptcy committee.

First Brands Had Off-Balance Sheet Trouble

First Brands had previously disclosed $5.9bn in long-term debt and nearly $1bn in cash. But creditors now fear the true scale of its obligations is far higher due to complex financing tied to invoices and inventory. Several investment firms, including Jefferies’ (JEF) asset management arm, are listed among creditors exposed to the company’s so-called “factoring” deals.

The crisis escalated after one of its banks seized cash, forcing the group to seek Chapter 11 protection. First Brands has since secured $1.1bn in debtor-in-possession financing to keep operations running as it restructures.

Markets Face the Fallout

The collapse has already been compared with the recent bankruptcy of subprime auto lender Tricolor. Together, they raise concerns of multibillion-dollar losses for Wall Street firms and highlight fragility in private credit markets that fueled years of debt-funded expansion.

Over the past decade, James turned First Brands from a niche Ohio concern into a multinational spanning Romania, Mexico, and Taiwan. This rapid expansion, funded by leverage, is now being unwound.

The group’s international units were excluded from the filing, but Charles Moore of Alvarez & Marsal has been brought in as chief restructuring officer to guide the turnaround.

In addition, the bankruptcy lands hard on an auto parts sector already under stress from President Donald Trump’s tariffs. With global supply chains in flux, First Brands’ failure could create new headaches across the industry.

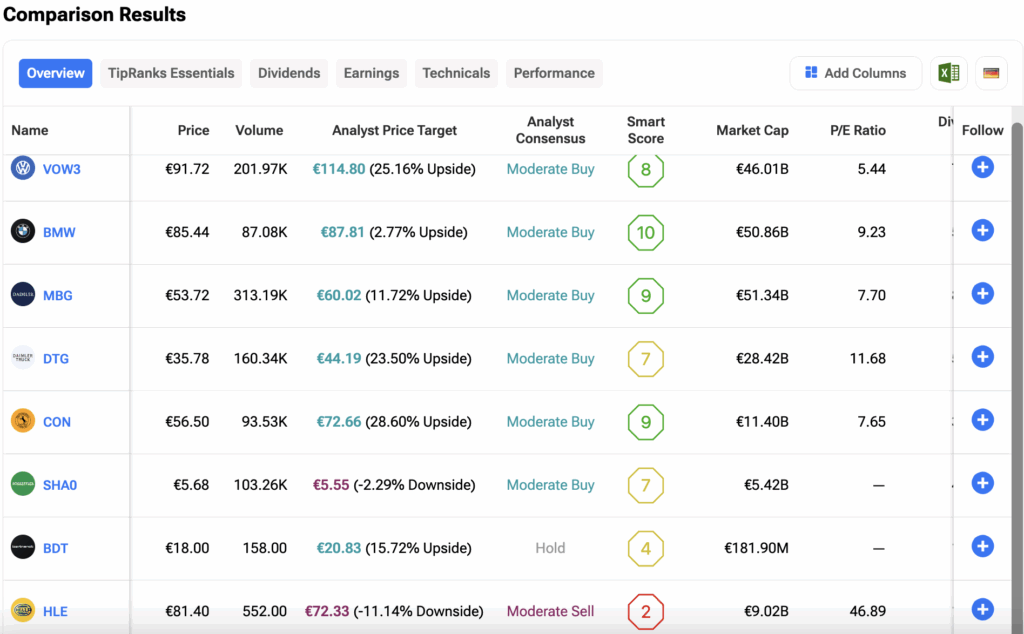

Investors can compare automotive stocks side-by-side based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to explore the tool.