Asset management giant Fidelity Investments has re-filed the paperwork for its spot Bitcoin (BTC-USD) exchange traded fund (ETF), called Wise Origin Bitcoin Trust, with the U.S. Securities and Exchange Commission (SEC). Fidelity has now joined BlackRock (NYSE:BLK), the world’s largest asset manager, and Cathie Wood’s Ark Investment Management, in the race to launch the first spot Bitcoin ETF. The SEC rejected Fidelity’s previous application in 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Race for the Spot Bitcoin ETF

Earlier this month, BlackRock filed an application for a spot Bitcoin ETF, named iShares Bitcoin Trust. The news boosted the sentiment in the crypto market and positively impacted BTC. Since then, Invesco Ltd. (NYSE:IVZ), WisdomTree (NYSE:WT), VanEck, and Valkyrie have applied for their own Bitcoin funds.

On Wednesday, Cathie Wood’s Ark Investment Management filed an amended spot Bitcoin ETF application with the SEC. With this amended proposed fund, Cathie Wood’s Ark is being seen as the frontrunner in the spot Bitcoin ETF race, as various sources reported that the SEC’s decision on ARK’s application is scheduled for August 13, 2023, while there is no set date known yet for other applicants.

The SEC has approved several Bitcoin futures-based ETFs previously, but has so far not given a nod to a spot Bitcoin fund. Recent rejections by the regulatory body come amid significant risks related to transparency in the crypto market and the potential for manipulation. The SEC has heightened its crackdown on crypto firms since the FTX debacle shook the crypto market. It recently sued crypto exchanges Binance (BNB-USD) and Coinbase Global (NASDAQ:COIN).

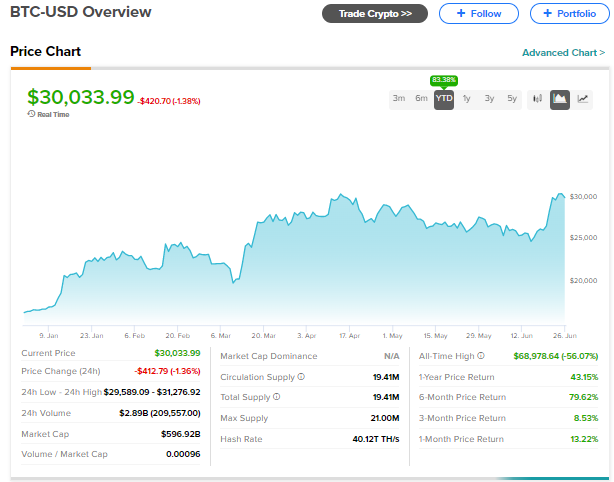

Meanwhile, the rush for spot Bitcoin ETF by credible asset management companies has lifted Bitcoin prices recently. BTC-USD, the largest cryptocurrency by market value, is trading above $30,000 compared to below $26,000 levels prior to the BlackRock filing. It is up over 80% on a year-to-date basis.