Shares of logistics and transportation giant, FedEx (NYSE: FDX) inched up higher after Stifel analyst J. Bruce Chan upgraded the stock to a Buy and raised the price target to $222 from a prior price target of $171. Chan’s price target implies an upside potential of 12.7% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst stated that early signs indicate that the company’s cost-savings initiatives are paying off and the stock presents a “compelling investment opportunity.”

Chan wrote in his research note to investors, “We’ve been vocal about what we felt were significant operating deficiencies at FedEx in recent quarters, but at least some of the conditions that we laid out for getting more constructive have started coming to fruition, including pull-forward and early progress on FY23 cost takeout initiatives.” The analyst added that while the company’s management still has plenty of work to do, “at current valuation levels, we believe the risk/reward offers upside potential for FDX shares, which could grow as more progress is made with productivity initiatives.”

FedEx is expected to report its Q3 earnings today after market close and analysts are expecting the company to report earnings of $2.72 per share on revenues of $22.2 billion.

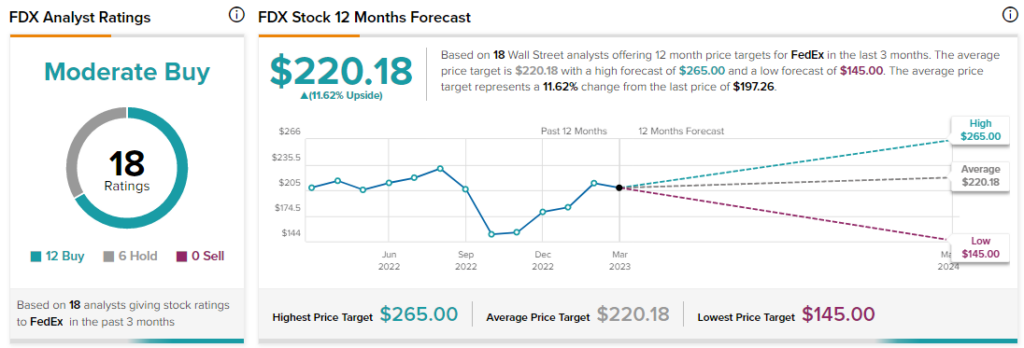

Meanwhile, besides Chan, other Wall Street analysts are cautiously optimistic about FDX stock with a Moderate Buy consensus rating based on 12 Buys and six Holds.