Can the market learn to love FedEx (NYSE:FDX), even if the company’s financial results are mixed? It’s definitely possible, and today’s share-price action is clear evidence that investors are willing to forgive some of FedEx’s shortcomings. In light of the company’s strong points, I am bullish on FDX stock and expect it to continue its upward momentum.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FedEx is a package delivery service with strong brand-name recognition in the U.S. However, the economy hasn’t been stellar lately, and that’s a major problem for FedEx since there will be fewer package deliveries when customers cut back on purchases.

Still, FedEx is being proactive by implementing cost-control measures. One can see the impact of these measures in FedEx’s latest round of quarterly results. So, after you’ve fully considered FedEx’s challenges and opportunities, you just might decide to take a small share position.

Why Did FedEx Stock Rally Today?

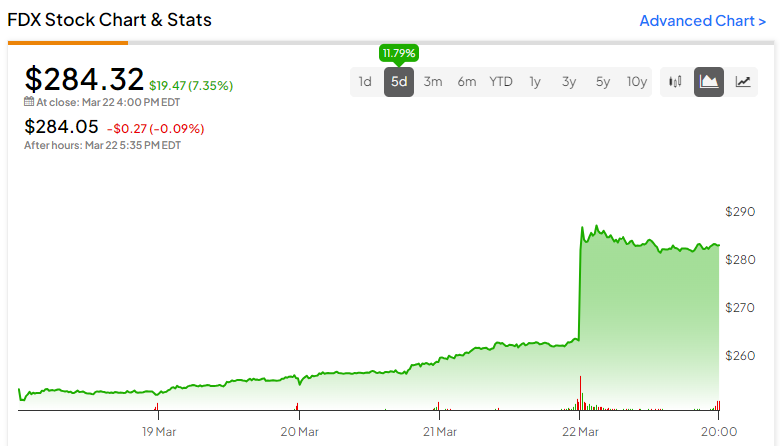

Interestingly, FedEx’s Fiscal Q3-2024 results were mixed, but FDX stock gained 7.3% today. Sometimes, the market chooses to focus on certain data points while overlooking (or at least forgiving) others.

I’ll start with the bad news first. FedEx posted its sixth consecutive quarter of year-over-year revenue declines, as the company’s revenue fell 2.3% year-over-year to $21.7 billion. Furthermore, this result fell short of the consensus estimate by $380 million.

Also, for full Fiscal Year 2024, FedEx anticipates a “low-single-digit percentage decline in revenue year over year.” Therefore, in terms of top-line results, FedEx didn’t bring a special delivery of good news this time.

So, why would FDX stock rally despite FedEx’s less-than-ideal revenue result and outlook? Stay tuned, as the company also delivered positive news for shareholders to celebrate.

As FedEx CEO Raj Subramaniam explained, the company is undergoing a “transformation.” Presumably, this means changing FedEx into a leaner, more efficient company.

At the very least, there’s been a positive “transformation” in FedEx’s bottom-line results. In Q3 of FY2024, the company earned $3.86 per share, beating the consensus estimate of $3.46 per share. This result puts FedEx back on track after missing the consensus EPS estimate in the prior quarter.

Another piece of good news is there was significant margin expansion in Express, which is FedEx’s largest unit. More specifically, in the third quarter of FY2024, Express’s operating margins improved to 2.5% versus just 1.2% in the year-earlier quarter.

FedEx Succeeds with Cost-Control Measures

FedEx’s EPS beat is impressive, but it might actually be the company’s Express margin improvement—made possible by cost-cutting measures—that prompted today’s share-price rally. As Evercore ISI analyst Jonathan Chappell explained, “The positive stock price reaction is nearly strictly a function of the Express margins easily beating expectations.”

What were these margin-improving cost-control measures, exactly? According to a Reuters report, these measures included “parking aircraft, reducing flight hours and other efforts to fly fewer, fuller planes.”

In the opinion of TD Cowen analyst Helane Becker, FedEx’s “cost-cutting initiative is working.” As evidence of this, FedEx’s operating income has increased for three consecutive quarters, even though the company’s revenue has declined. Hence, even if the economy is fragile and there’s less revenue to be generated, FedEx is dealing with this successfully by becoming more efficient.

Delving into the data, FedEx’s Q3-FY2024 GAAP operating income grew 19% year-over-year to $1.24 billion; on an adjusted (non-GAAP) basis, it increased by 16% to $1.36 billion. Even the skeptics must acknowledge that this is an impressive achievement during these challenging times.

FedEx actually has a name for its “transformation” plan: the DRIVE program. Subramaniam touted the evident success of this program, declaring, “FedEx delivered another quarter of improved profitability in what remains a difficult demand environment, reflecting outstanding service and continued benefits from DRIVE.” Investors should continue to monitor FedEx’s quarterly results to see if the company’s DRIVE program does, indeed, drive further operating income improvement.

Is FedEx Stock a Buy, According to Analysts?

On TipRanks, FDX comes in as a Moderate Buy based on 11 Buys and four Hold ratings assigned by analysts in the past three months. The average FedEx price target is $307.50, implying 8.2% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell FDX stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jack Atkins of Stephens, with an average return of 20.71% per rating and a 66% success rate. Click on the image below to learn more.

Conclusion: Should You Consider FedEx Stock?

FedEx’s fiscal picture isn’t perfect in every respect. Declining revenue is a red flag, but that’s in the midst of a larger number of green flags. Most importantly, FedEx’s DRIVE program appears to be putting the company in the driver’s seat with effective cost-reduction measures. So, while many financial traders were previously uninterested in FedEx, the tide appears to be turning now. Thus, FDX stock is catching a bid today, and I’m considering it for a long-term position.