The U.S. Federal Reserve announced on June 29 that its much-awaited FedNow Payments system is expected to launch in late July, after nearly eight years in the making. The updated instant payment infrastructure will allow instant transfers of funds between accounts, instant bill payments, and paycheck transfers. It will also enable instant services for a wide range of other consumer and business-related transactions. Plus, the new system will function 24/7, 365 days a year, in contrast to the current system, which is closed on holidays and weekends and takes several days to process certain transactions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Details of the FedNow Payments System

The central bank said that around 57 financial institutions, including big and small banks and credit unions, have already participated in the new payments system. These institutes have completed initial testing and compliance procedures to integrate into the new FedNow Payments system. They are now engaging in the final run of the service to check the readiness of their platforms to support the FedNow service. The system will include the participation of 41 financial institutions that are engaged in the sending, receiving, and settlement processes. Additionally, there will be 15 service providers responsible for processing the transactions on behalf of the participants, including the U.S. Department of Treasury.

Some of the banks include JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and BNY Mellon (NYSE:BK). These banks will go live with the new system in July, once the FedNow system goes live, or shortly after. The Federal Reserve has cautioned that it may take a few years for widespread adoption of the system.

With the launch of the FedNow Payments system, the American populace will benefit from the instant processing of financial transactions. It will also save people from high-interest payments to payday lenders and check-cashing stores, which fill the void created by the Fed’s current banking system.

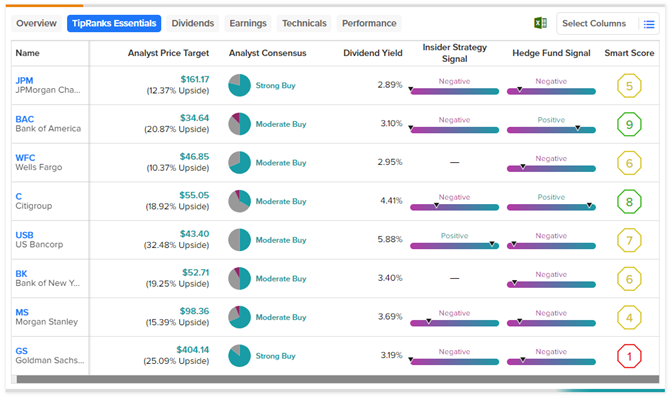

To compare the performance of some of the big American banking stocks, refer to the list below: