Shares of FedEx (NYSE:FDX) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $4.94, which beat analysts’ consensus estimate of $4.85 per share. Sales decreased by 10.2% year-over-year, with revenue hitting $21.9 billion. This missed analysts’ expectations of $22.66 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FedEx bought back nine million shares of stock during the 2023 fiscal year and still has around $2.3 billion left in its authorized share repurchasing fund. More buyback action will likely take place going into their 2024 fiscal year.

Meanwhile, FedEx management also offered some forward guidance and expects comparatively low growth, in the “flat to low-single-digit-percent” range on a year-over-year measurement. Earnings per share are expected between $15 and $17, which beats consensus estimates of $14.87. FedEx also noted that the DRIVE initiative will bring in $1.8 billion in permanent cost reductions and expects to spend $5.7 billion in capital expenditures to drive gains in efficiency, network optimization efforts, and improve the use of automation.

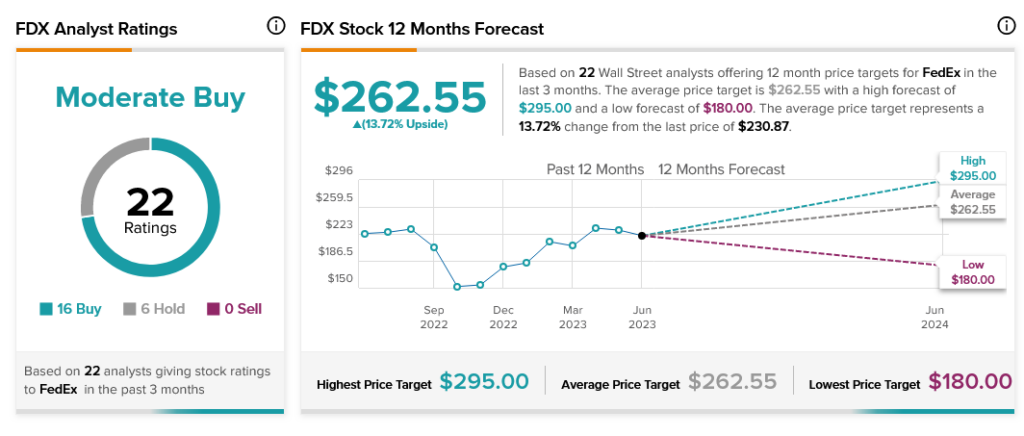

Overall, Wall Street has a consensus price target of $262.55 on FedEx, implying 13.72% upside potential, as indicated by the graphic above.