Fashion retailer Lululemon (NASDAQ:LULU) is making something of a comeback, and it’s largely thanks to three key factors: back to school, the unexpected rise of the fanny pack, and China. That combination of factors fueled some impressive results, pushing LULU stock to a new 52-week high at one point in today’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

They’re calling it the “Everywhere Belt Bag” these days, even if it looks a lot like the fanny packs of yore. But whatever they call it, it’s clear customers want to call it their own in ever-increasing numbers. That, coupled with a surge in Chinese customers and the onrush of kids heading back to school, left Lululemon in the catbird seat ahead of an impressive earnings announcement. Indeed, it was impressive; Lululemon’s second quarter featured a modest beat for earnings and revenue, along with the surprise revelation that its revenue was up 18.2% against 2022’s second quarter.

The news was enough to pull analysts in from all over; Bank of America maintained its Buy rating, especially considering the macroeconomic environment that should have produced gunshy consumers but instead brought in the splurgers from all over. Morgan Stanley’s analysts, meanwhile, called Lululemon a “stand out in our coverage” and kept its own Buy recommendation in place. While there are signs that consumers are being picky, they’re still spending, and Lululemon seems to fit the bill well.

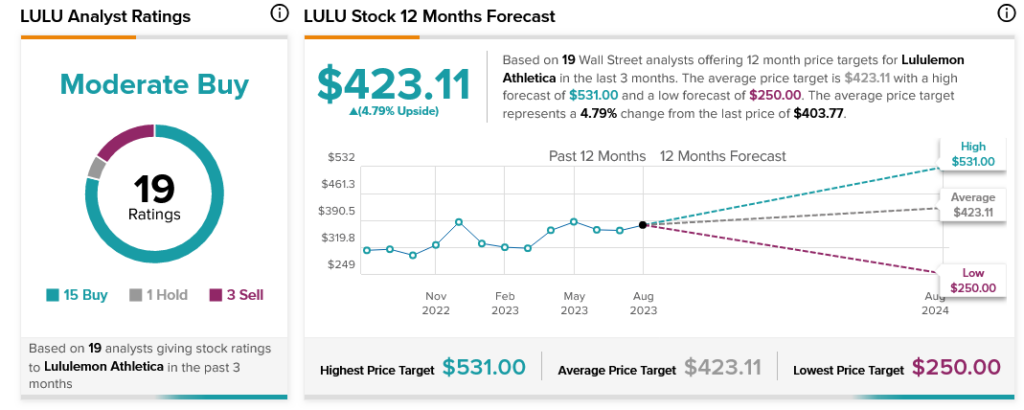

Analysts throughout the spectrum were mostly in agreement. Currently, Lululemon stock is considered a Moderate Buy, as defined by 15 Buy ratings, one Hold, and three Sells. Further, with an average price target of $423.11, Lululemon stock comes with 4.79% upside potential.