Shares of the multi-cloud application services and security company F5 (NASDAQ:FFIV) jumped over 9% in Monday’s after-hours of trading. The company’s solid Q1 earnings and improving demand outlook lifted its stock higher.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

F5 stock has gained over 27% in one year, outperforming the S&P 500’s (SPX) gain of approximately 22%.

FFIV – Q1 Performance

FFIV’s revenue declined 1% year-over-year to $693 million in Q1, reflecting lower product sales. However, its top line exceeded the high end of its guidance range and surpassed Street’s forecast of $685.4 million.

While F5’s top line witnessed a year-over-year decline amid lower enterprise spending, its bottom line recorded stellar growth. The company posted earnings of $3.43 per share, up about 39% year-over-year. Moreover, it exceeded the Street’s EPS forecast of $3.04.

The significant increase in FFIV’s earnings reflects the company’s tight cost-control initiatives, which significantly boosted its margins. Notably, F5’s adjusted gross and operating margins expanded by 270 and 900 basis points, respectively.

Demand Shows Signs of Improvement

The company’s first-quarter performance surpassed expectations. But what stood out was the management’s commentary regarding the demand environment.

FFIV’s management said that while its customers maintain tight control over their spending, the company is witnessing strong underlying demand trends. The management sees an increase in demand for its systems products as a potential signal of increased enterprise spending.

What is the Forecast for F5?

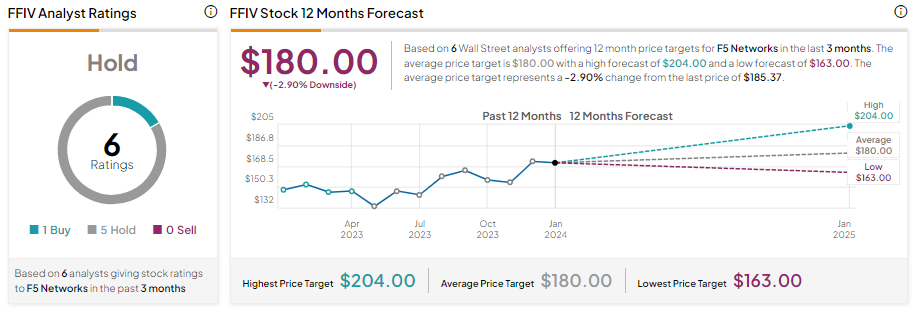

Analysts remain cautious due to a tough operating environment and near-term backlog headwinds. With one Buy and five Hold recommendations, F5 stock has a Hold consensus rating on TipRanks. Analysts’ average price target of $180 implies 2.9% downside potential from current levels.