Automaker Ford (F) reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at $0.45, which beat analysts’ consensus estimate of $0.35 per share. Sales increased by 9.6% year-over-year, with revenue hitting $47.19 billion. This also beat analysts’ expectations of $47.05 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the company lowered its 2025 outlook due to a fire at a Novelis aluminum plant in New York, which is disrupting production of its high-margin trucks and SUVs. Ford expects the fire to cost between $1.5 billion and $2 billion but believes it can recover much of that by ramping up production in 2025 and 2026. As a result, the company plans to add 1,000 workers in Michigan and Kentucky next year to help recover around 50,000 lost vehicles.

Ford’s Guidance for FY 2025

Looking forward, management has provided the following guidance for FY 2025:

- Adjusted EBIT of between $6 billion and $6.5 billion versus prior outlook of $6.5 billion to $7.5 billion

- Adjusted free cash flow of $2 billion to $3 billion

Interestingly, CFO Sherry House said that Ford would have raised its forecast to over $8 billion if not for the fire. Meanwhile, the automaker also lowered its expected tariff costs by $1 billion, thanks to recent policy changes by the Trump administration.

In addition, Ford remains optimistic about its Ford+ transformation plan, which aims to cut $1 billion in costs this year and make the company more efficient.

What Is Ford’s Target Price?

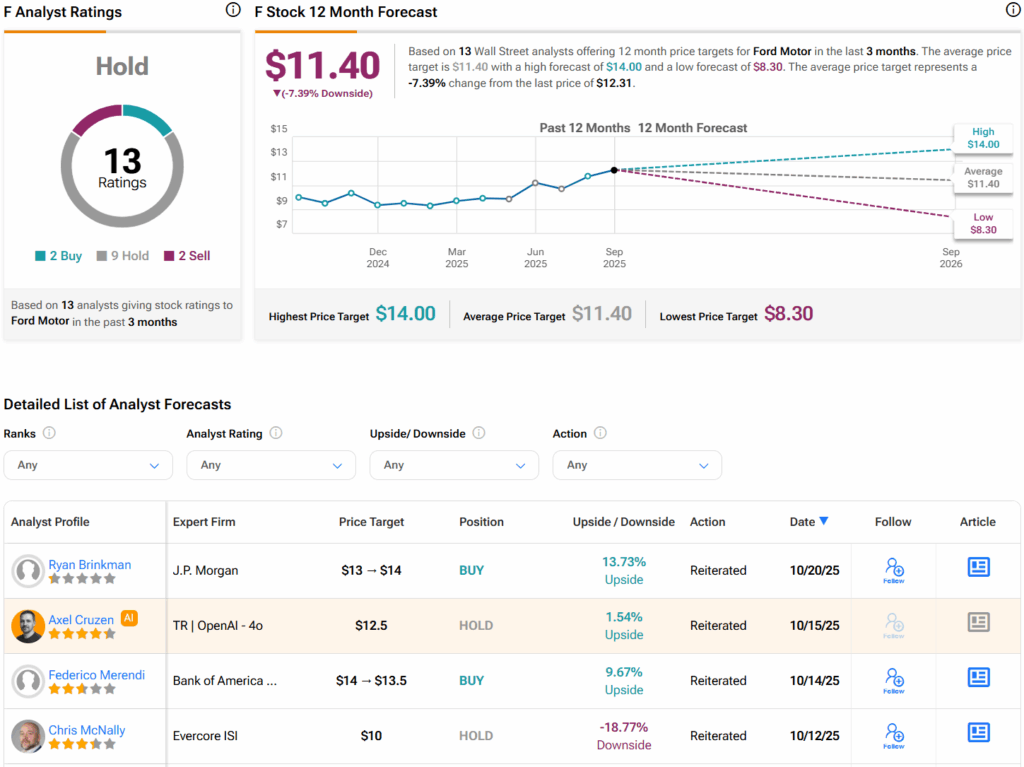

Turning to Wall Street, analysts have a Hold consensus rating on Ford stock based on two Buys, nine Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Ford price target of $11.40 per share implies 8.4% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.