Shares of energy giant Exxon Mobil (NYSE:XOM) are trading marginally lower today after its second-quarter numbers fell short of expectations with revenue dropping 28.3% year-over-year to $82.9 billion. EPS at $1.94 missed the cut by $0.10.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

By the end of 2023, the company is aiming to structurally lower costs by $9 billion as compared to 2019. With a 20% year-over-year growth, production in Guyana and the Permian basin remained at record levels even as Exxon took steps to boost its Low Carbon Solutions business with the recent acquisition of Denbury. The move could potentially help lower Gulf Coast industrial emissions by 100 MMT annually.

Further, Exxon generated $5 billion in free cash flow in Q2 and has declared a quarterly dividend of $0.91 per share. The dividend is payable on September 11 to investors of record on August 16.

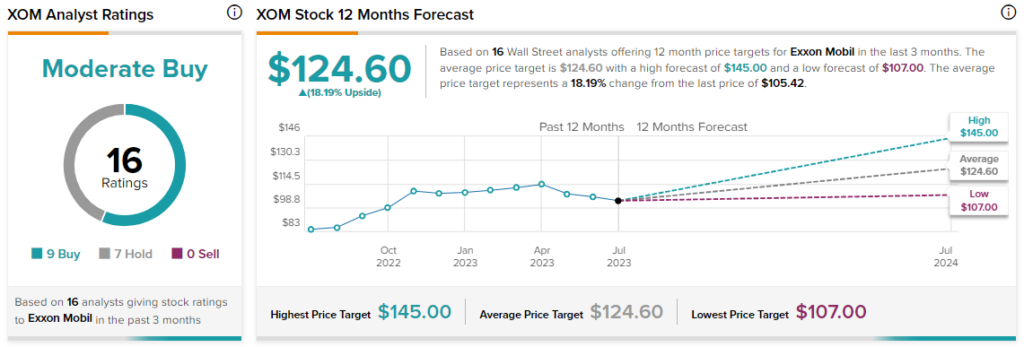

Overall, the Street has a $124.60 consensus price target on Exxon alongside a Moderate Buy consensus rating. Shares of the company have gained nearly 15% over the past year.

Read full Disclosure