Oil and gas giant Exxon Mobil (NYSE:XOM) expects lower natural gas prices and weaker refining margins to significantly hit its second-quarter earnings. Macro pressures have weighed on energy prices, pulling them down from the elevated levels seen last year due to the Russia-Ukraine war. Moreover, the slower-than-anticipated recovery in China has impacted oil and gas demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Exxon’s Q2 Earnings Under Pressure

Exxon expects lower gas prices to drag down Q2 2023 upstream earnings by $1.8 billion to $2.2 billion compared to the first quarter. Per Reuters, U.S. natural gas futures were trading at $2.657 per million British thermal units on Wednesday, marking the lowest level in two years. Prices have been impacted by stock-piling and lower consumption levels in Europe.

Additionally, Exxon expects weaker refining margins to pull down its Q2 downstream earnings by $2.0 billion to $2.2 billion on a quarter-over-quarter basis. Meanwhile, Q2 earnings are anticipated to gain from a favorable change in unsettled derivatives and a rise in industry margins of the chemical products.

Exxon delivered record earnings in 2022 due to a spike in oil and gas prices. The company’s solid earnings supported shareholder distributions of $29.8 billion last year, including $14.9 billion in dividends.

Is Exxon a Buy, Sell, or Hold?

Following the update, Bank of America analyst Doug Leggate noted that at the mid-point, net income would be $7.9 billion in Q2, down 56% year-over-year and 31% quarter-over-quarter, respectively, reflecting extraordinarily favorable conditions in 2022. The analyst continues to expect a cash flow of $13.9 billion in Q2.

Wall Street is cautiously optimistic on Exxon stock, with a Moderate Buy consensus rating based on eight Buys and five Holds. The average price target of $127.96 implies about 20% upside. Shares are down 3% year-to-date.

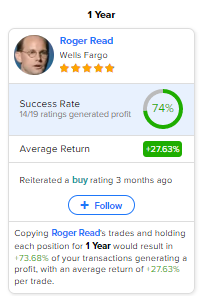

It is worth noting that Wells Fargo analyst Roger Read is the most accurate analyst for XOM stock, according to TipRanks. Copying Read’s trades and holding each position for one year could result in 74% of an investor’s transactions generating a profit, with an average return of 27.6% per trade.