Energy giant Exxon Mobil’s (NYSE:XOM) German and Dutch subsidiaries have filed a lawsuit against the European Union (EU), challenging its decision to impose a windfall tax on the high profits generated by oil and gas companies. Energy behemoths are being targeted for the solid profits they generated in the first nine months of 2022 due to the high prices triggered by the Russia-Ukraine war.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Exxon Challenges EU’s Windfall Tax

EU’s windfall tax will be effective from December 31, 2022. A windfall tax of at least 33% will be imposed on any taxable profits in 2022-2023 that are 20% or more than the average profit for the 2018-2021 period. The lawsuit, which was first reported by the Financial Times, challenges the authority of the Council of the European Union to impose the windfall tax, which Exxon contends is a direct income tax.

Generally, all tax-related powers have been reserved at the national level for member states. The EU imposed the windfall tax using Article 122, an emergency tool that allows it to set a policy without involving the European Parliament. Exxon feels that the European Commission and the Council wrongfully used Article 122 to accelerate the approval of the windfall tax.

In a regulatory filing last month, Exxon stated that the EU’s windfall tax could cost it at least $2 billion through 2023-end. Exxon’s spokesman Casey Norton said that while the company acknowledges the adverse impact of Europe’s energy crisis on families and businesses, it feels that the new tax is “counterproductive.” Also, such a tax would “undermine investor confidence, discourage investment and increase reliance on imported energy and fuel products.”

Exxon also pointed out that it has been among the largest investors in European refining over the past ten years, and its investments have fueled increased production. It feels that such taxes could discourage oil companies from making further investments. Recently, Shell (NYSE:SHEL) also announced that it is evaluating its planned investments in the U.K., given the increase in windfall tax from 25% to 35%. Meanwhile, U.S. President Joe Biden has also criticized Exxon and other oil giants for “war profiteering” and threatened to impose a windfall tax on excess profits.

What is the Target Price for Exxon Stock?

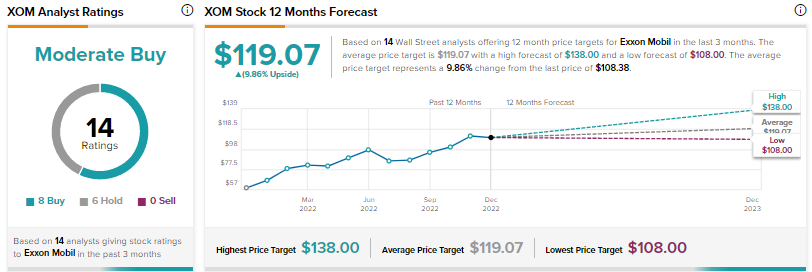

Wall Street’s Moderate Buy consensus rating for Exxon stock is based on eight Buys and six Holds. The average XOM stock price target of $119.07 implies upside potential of nearly 10%. Shares have rallied over 77% year-to-date.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.