Energy giant Exxon Mobil (NYSE:XOM) might wind down its oil operations in Equatorial Guinea and leave the country once its license expires in 2026, Reuters reported, citing two sources close to the matter. High costs and carbon emissions associated with crude oil production in the country have been concerning.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Exxon and other oil giants have been contemplating reducing their crude oil production in West Africa. Instead, they intend to direct their investments toward lower-carbon natural gas projects in the region and to more profitable projects in the Americas.

Exxon is now planning to decommission its Zafiro oil field in Equatorial Guinea. The Zafiro offshore production platform was shut down in September because water entered the aging vessel. The company’s oil production in Equatorial Guinea has fallen to nearly 15,000 barrels of oil per day (bpd) from about 45,000 bpd prior to the accident. Aside from Zafiro, Exxon operates the Serpentina offshore oil platform in Equatorial Guinea.

As per Bloomberg, Exxon spokeswoman Meghan Macdonald stated in an emailed statement, “We’re currently evaluating the best option for safe decommissioning, in close collaboration with Equatorial Guinea’s Ministry of Mines and Hydrocarbons.” However, Macdonald declined to react to the Reuters report about the company exiting the country.

While crude production is declining in West Africa, major energy companies are investing in liquefied natural gas in the region to meet the needs of Europe, which is looking for other sources to replace supply from Russia amid western sanctions.

What is the Prediction for Exxon Stock?

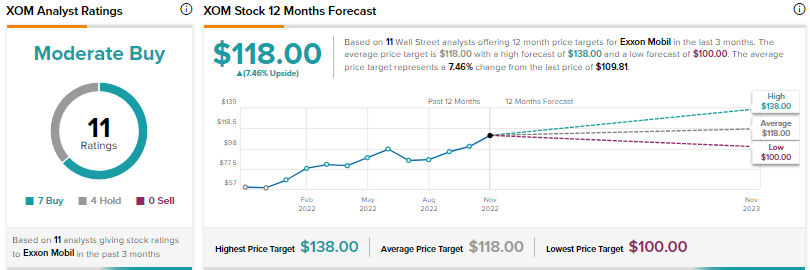

Exxon stock has rallied 79% year-to-date amid high oil prices triggered by the Russia-Ukraine war. Following the strong run, Wall Street is cautiously optimistic about Exxon stock, with a Moderate Buy consensus rating based on seven Buys and four Holds. The average XOM stock price target of $118 implies 7.5% upside potential from current levels.