Oil and gas giant Exxon Mobil’s (NYSE:XOM) shale gas unit head, David Scott, was arrested on Thursday, October 5, on charges of sexual assault. Scott is the vice president of Exxon’s upstream unconventional unit, which is currently working out a plan for the $60 billion takeover of Pioneer Natural Resources (NYSE:PXD).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Scott’s current role involves overseeing Exxon’s operations in the Permian basin, which is known as America’s wealthiest oil field. The Permian Basin spreads across Texas and New Mexico and is one of the most important operations of Exxon. Scott’s arrest comes at a crucial time when ExxonMobil is preparing for one of its biggest acquisitions. Following PXD’s buyout, Exxon is set to become a major player in the Permian, controlling roughly 15% of the total oil production.

Scott has been working for Exxon for the last 26 years at its various operations in Australia, the U.K., the U.A.E., and Angola. Following his arrest, Exxon stated that Scott would not continue with his work responsibilities. In a public statement, Exxon stated, “All ExxonMobil employees, officers, and directors are accountable for observing the highest standards of integrity and code of conduct in support of the company’s business and otherwise.”

Is Exxon a Buy, Sell, or Hold?

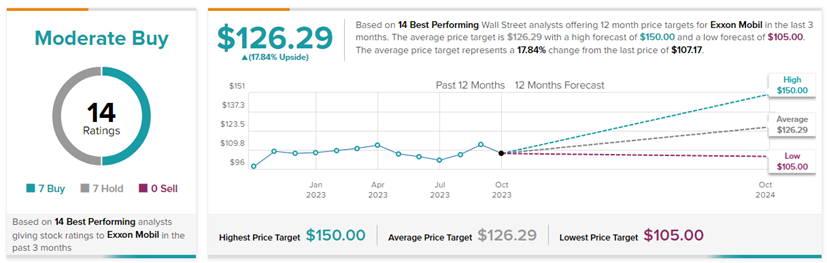

Of the 14 Top Analysts who recently rated Exxon stock, seven have given it a Buy rating while seven have given it a Hold rating. Top Wall Street analysts are those awarded higher stars by the TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these analysts’ views, Exxon has a Moderate Buy consensus rating. The average Exxon Mobil price target of $126.29 implies 17.8% upside potential from current levels. Year-to-date, XOM stock has gained 3.1%.