Out of all the potential calamities one could encounter in Australia, perhaps the last one on the list would be “running out of natural gas.” That’s the warning that oil stock Exxon Mobil (NYSE:XOM) offered up, and it was a warning that didn’t mean much to shareholders. In fact, shareholders sent Exxon stock down only fractionally in Tuesday afternoon’s trading after the warning came out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Exxon took to the Australian Domestic Gas Outlook conference in Sydney with a stark warning. Australia desperately needs new investment in gas and oil production, and it needs it pretty rapidly to establish energy security or maintain affordable prices. Though admittedly, these days, “affordability” is something of a relative term. At any rate, Exxon Mobil Australia pointed out that it currently takes as long as two years to establish and use an offshore drilling permit in Australia. With domestic supplies set to drop by 44% by 2030, the time to start drilling is now.

Already Looking Elsewhere

Perhaps Exxon Mobil doesn’t think much of Australia’s plans to step up permitting for new offshore drilling and extraction efforts because it’s already working on shoring up its hydrogen operations. In fact, Exxon Mobile and the largest power generator in Japan are already working together to “jointly explore” new developments in “blue” hydrogen production. That’s expected to produce around 900,000 metric tons of hydrogen and over a million metric tons of ammonia annually at a facility in Texas.

What Is the Target Price for XOM?

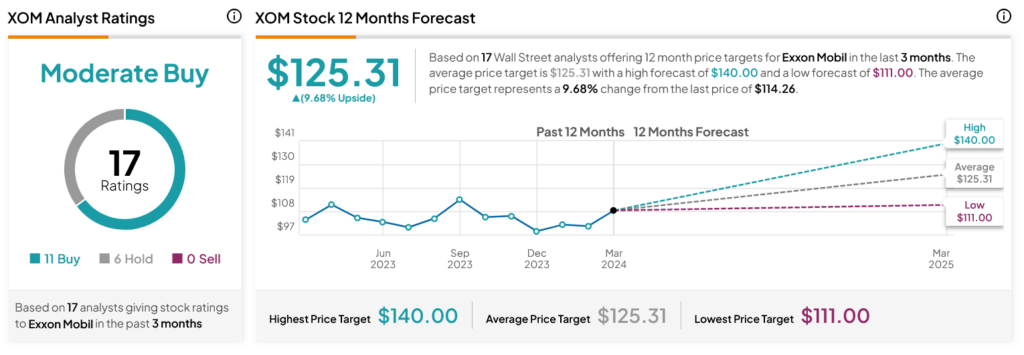

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XOM stock based on 11 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After an 11.81% rally in its share price over the past year, the average XOM price target of $125.31 per share implies 9.68% upside potential.