For those who balk at investing in oil stock Exxon Mobil (NYSE:XOM) because it’s insufficiently green, it may be about to change your mind, at least somewhat. New reports say Exxon is looking to reveal more about its methane production worldwide. That move left investors largely nonplussed in Thursday’s trading as it spent the afternoon fractionally up and down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Previously, Exxon resisted calls to join a new United Nations initiative that tracked methane production worldwide. But now, Exxon is considering getting in on said program and filling in the world about just how much methane it’s making. Known as the Oil & Gas Methane Partnership, the initiative tracks the production of said gas by the companies that produce much of the world’s supply of oil and gas. Interestingly, Exxon considering joining in might be connected to Pioneer Natural Resources, which Exxon recently agreed to acquire in a $59.5 billion deal. Pioneer was a member of the OGMP before the deal.

But that’s not the only change wrought by the purchase of Pioneer. Reports note that, as a result, Exxon Mobil is now the world’s first “megamajor.” The report came from Wood Mackenzie‘s senior vice president of corporate research, Tom Ellacott. Ellacott noted that Exxon was now “…in a peer group of one” thanks to the sheer amount of oil it pumps. With Pioneer’s acquisition, Exxon will gain more than 700,000 barrels of oil equivalent production out of the Midland Basin, along with over 16 billion barrels equivalent in the Permian. That immediately bypassed Chevron (NYSE:CVX), Exxon Mobil’s closest competitor, by a solid margin.

Is Exxon a Good Buy Right Now?

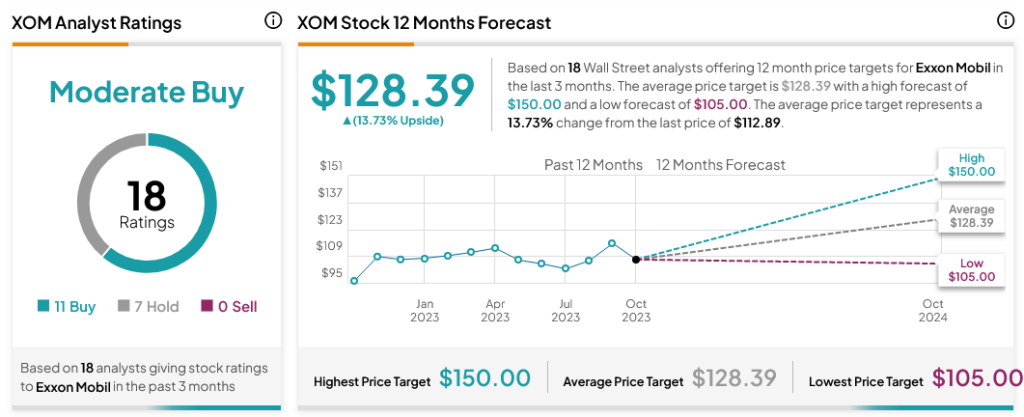

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XOM stock based on 11 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average XOM price target of $128.39 per share implies 13.72% upside potential.