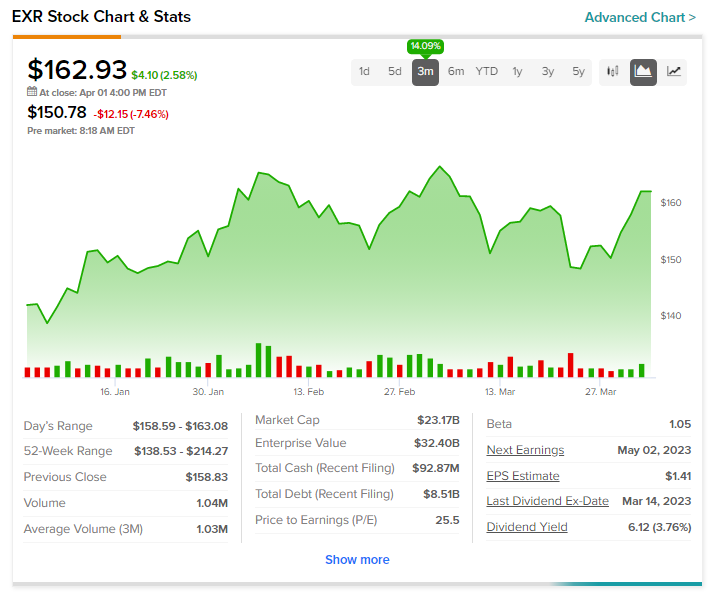

Shares of Extra Space Storage (NYSE: EXR) were down in pre-market trading on Monday as the self-administered and self-managed equity REIT announced a merger with Life Storage (LSI) in an all-stock deal. According to the terms of the deal, Life Storage shareholders will receive 0.8950 of an Extra Space share in exchange for each Life Storage share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This represents a total consideration of around $145.82 per share based on Extra Space’s share price close on March 31. After the close of the transaction, Extra Space shareholders are expected to own around 65% while Life Storage shareholders are expected to own the remaining 35% of the combined company. The combined company will have a pro forma equity market capitalization of around $36 billion and a total enterprise value of approximately $47 billion.

This deal is expected to “increase the size of Extra Space’s portfolio by more than 50% by store count with the addition of Life Storage’s 1,198 properties, including 758 wholly-owned, 141 joint venture, and 299 third-party managed stores. In total, the transaction adds over 88 million square feet to the portfolio.”

EXR stock has soared by more than 14% in the past three months.