One of the biggest troubles connected to the green energy movement is that green power is often transient and based on conditions. Solar power is nothing at night. Wind power does nothing on a calm day. But being able to store power generated at high noon and in windstorms is a big plus, and Exro Technologies (TSE:EXRO) gained over 4% in Monday afternoon’s trading thanks to its first pilot order and a lifted non-disclosure agreement (NDA).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Exro Technologies announced that it’s planning its first pilot location for the Cell Driver energy storage system thanks to a new partnership with Alberta’s Red Deer Polytechnic. With Red Deer on board, Exro will sell off a Cell Driver power storage system that will be added to Red Deer’s Energy Innovation Center by the end of 2024’s first quarter. That’s immediately after Exro itself lands UL certification, expected by the end of 2023.

Better yet, that’s just the first such plan; Cell Driver systems are expected to be part of the landscape in several places, from warehouses and vertical gardening operations to even restaurants. Further, it also lifted an NDA with Giaffone Electric, which Exro revealed also set up some purchase orders with Exro to bring in new systems. In this case, however, it was Exro’s Coil Driver system, which should work well with Giaffone’s line of electric mobility systems.

Just in the Nick of Time for Investors, Too

This news comes at an excellent time for Exro’s investors, who have seen phenomenal gains over the long term, though not so much in the near term. While shares of Exro have increased 371% over the last five years, they’ve actually slipped 19% in the last three months alone. That may be prompting concerns among investors who wonder where their gains are going and how much longer Exro will be hemorrhaging value. With buyers lining up, though, to get in on these pilot projects, a turnaround from the recent losses may be closer than expected. That, in turn, could be prompting the sudden optimism.

Is EXRO Stock a Good Buy?

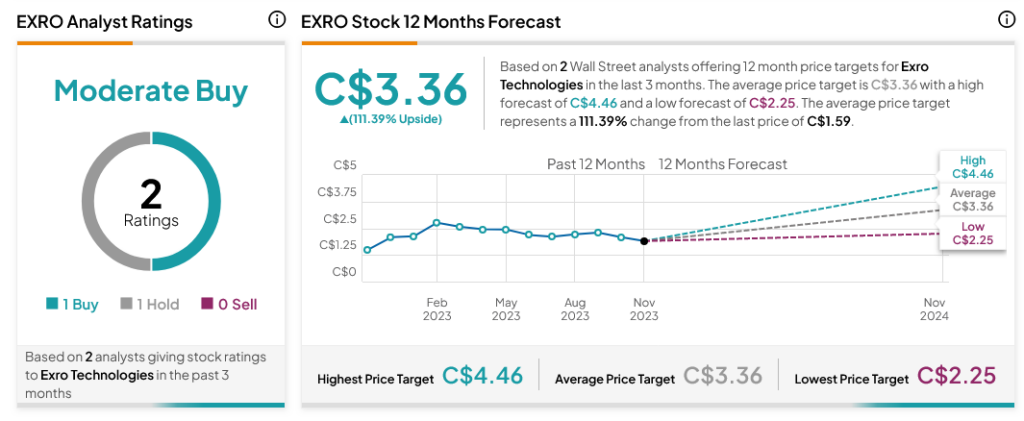

Turning to Wall Street, analysts have a Moderate Buy consensus rating on EXRO stock based on one Buy and one Hold assigned in the past three months, as indicated by the graphic below. After a 2.63% rally in its share price over the past year, the average EXRO price target of C$3.36 per share implies 111.39% upside potential.