Did it look like gas prices were improving ahead of the holiday weekend? That improvement might be short-lived, as crude oil futures are on their way up ahead of the holiday close after more oil cuts were announced by Saudi Arabia. It’s also prompting a climb in several oil stocks and the United States Oil Fund (USO).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The reduced rate puts Saudi oil production down to roughly nine million barrels per day, which is the lowest it’s been since before COVID-19. The Saudis are eager to improve their position by cutting back on volume and driving up prices. However, there’s been little sign that the prices of oil are on the rise particularly steeply. With crude oil prices maintaining an overall weakness through most of the Saudi cutback, it’s little surprise that it’s been extended.

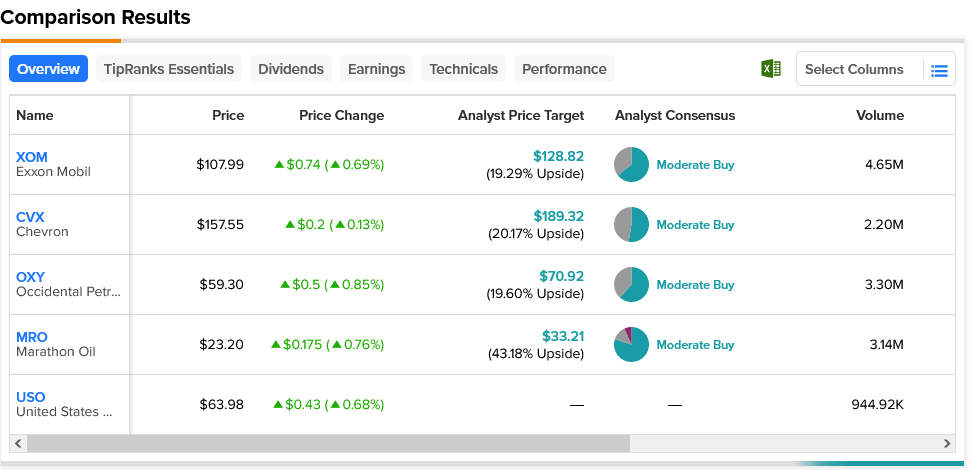

However, the Saudi cutback is getting a bit of help from another direction: the Russians. Russia cut its own output back in March, dropping back to 9.5 million barrels per day until the end of this year. Starting in August, it will cut exports by another half-million barrels per day through the rest of that time. The move certainly gave oil stocks a lift, if only fractionally; Occidental Petroleum (NYSE:OXY) added 0.85% at one point, while Marathon Oil (NYSE:MRO) added 0.76%. Exxon Mobil (NYSE:XOM) increased 0.69%, while Chevron (NYSE:CVX) notched up just 0.13%. The United States Oil Fund (USO), meanwhile, rose 0.68%.

All four of the oil stocks listed are considered Moderate Buys by analyst consensus, and each even offers upside possibilities. Marathon Oil comes out the best herein, though, with a potential gain of 43.18% on its $33.21 price target. Meanwhile, Exxon fares the least well, as its $128.82 price target offers 19.29% upside potential.