According to a Wall Street Journal report, investors have turned their backs on the shares of EVgo (NASDAQ:EVGO), ChargePoint Holdings (NYSE:CHPT), and Blink Charging (NASDAQ:BLNK) due to profitability concerns. Further, low utilization rate and equipment reliability concerns remain a drag. The report underscored that these charging stations will find it challenging to make money until a substantial number of drivers regularly utilize their networks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares of EVgo (NASDAQ:EVGO), ChargePoint Holdings (NYSE:CHPT), and Blink Charging (NASDAQ:BLNK) are down about 18%, 74%, and 62%, respectively, year-to-date. While these EV (electric vehicle) charging station operators have lost substantial value, Wall Street analysts are either sidelined or cautiously optimistic about their prospects.

With this backdrop, let’s look at what the Street recommends for EVGO, CHPT, and BLNK stocks.

What is the Future of EVgo?

EVGO’s network throughput increased to 37 GWh in the third quarter, compared to 12 GWh in the prior quarter. Further, the company added over 106,000 new customer accounts in Q3.

Wall Street analysts remain sidelined on EVgo stock despite an uptick in usage rate. Needham analyst Chris Pierce reiterated a Hold on EVGO stock on November 9. While the analyst acknowledged the improvement in utilization rate, long-term margin concerns and competitive pressures keep him sidelined.

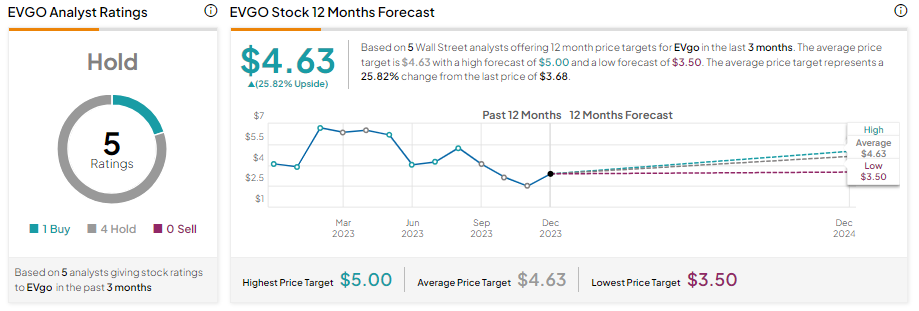

With one Buy and four Hold recommendations, EVGO stock sports a Hold consensus rating. Further, the average EVGO stock price target of $4.63 suggests that it has the potential to go up by 25.8% from current levels.

Is ChargePoint a Buy, Sell, or Hold?

ChargePoint stock is under pressure due to declining sales amid a weak macro environment. Though the stock has lost significant value, analysts are still cautiously optimistic about its prospects.

Goldman Sachs analyst Mark Delaney reiterated a Hold on CHPT stock on December 8. Although Delaney expects ChargePoint to gain from increasing EV adoption, increased competition will likely hurt margins.

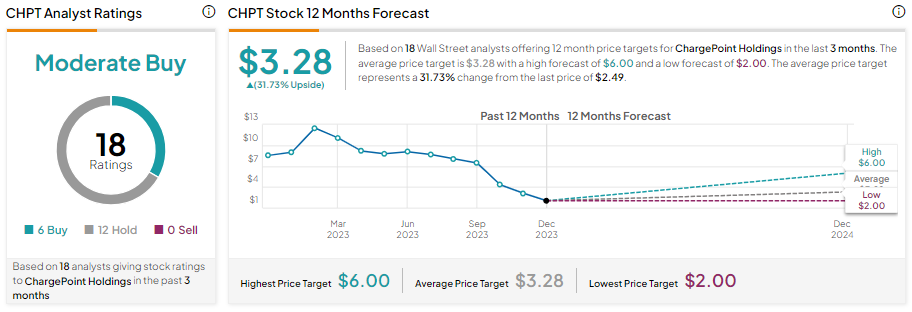

CHPT stock has a Moderate Buy consensus rating based on six Buy and 12 Hold recommendations. Moreover, analysts’ average price target of $3.28 implies 31.73% upside potential.

What is the Future of Blink Charging Stock?

Blink Charging’s focus on cost-cutting measures is positive. However, continued cash burn and pressure on margins keep analysts cautiously optimistic about its prospects.

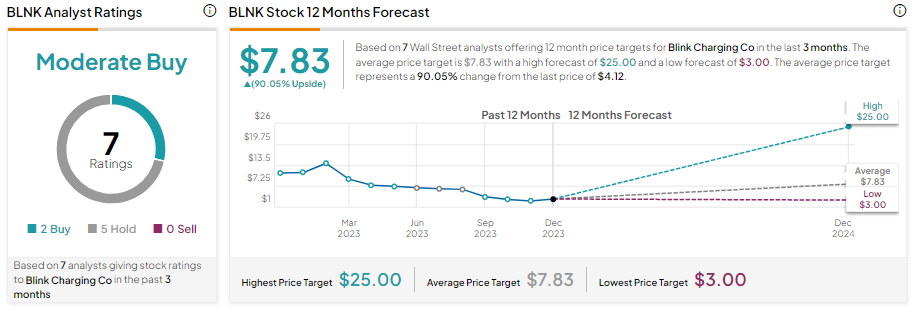

With two Buy and five Hold recommendations, BLNK stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $7.83 implies 90.1% upside potential from current levels.

Bottom Line

The continued margin headwinds and increased competition could continue to hurt the performance of EV charging stocks in the near term.