If you’re smelling ozone coming from the electric vehicle (EV) market, you’re not alone. Much of the industry is sputtering and sparking in Tuesday’s trading. However, two of the hardest-hit stocks in trading today are two of the biggest names: Tesla (NASDAQ: TSLA) and Nio (NASDAQ:NIO).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla has been under fire for months now, particularly since Elon Musk took over Twitter. That move left investors unconvinced he could continue to put his genius behind the next generation of carmaking if he was busy saving a failing social media platform too. Yet, many other troubling signs are on hand for Tesla as well. While Twitter certainly hurt the company, Tesla’s spate of discounts and rebates on its car models likely isn’t helping.

Meanwhile, at Nio, things aren’t looking much brighter. Nio cut its fourth-quarter outlook on delivery from between 43,000 and 48,000 vehicles to just 38,500 to 39,500. It couldn’t even match its lowest range. Such a sentiment was recently echoed around Tesla, as Tesla already failed to meet its own third-quarter estimates. Tesla listed a variety of reasons, including logistics problems and transportation issues, but the point remains: Tesla is on track to lose market share, and there are signs the entire EV market may have a tougher time selling cars in general.

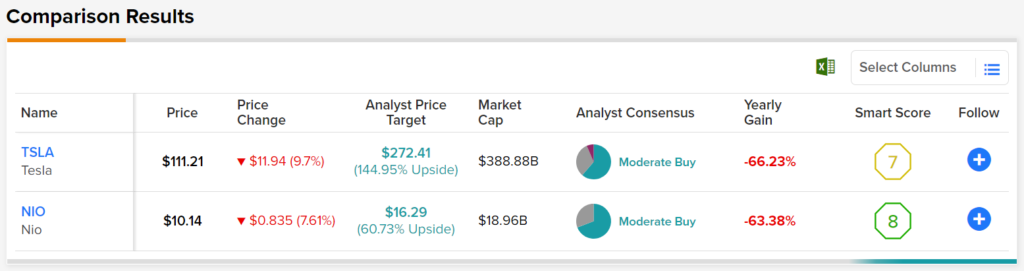

Tesla, currently, is a Moderate Buy as rated by analyst consensus. That’s the same rating Nio has. Tesla, meanwhile, currently offers 144.95% upside potential thanks to its average price target of $272.41. Nio, however, has an average price target of $16.29. That gives Nio an upside potential of 60.73%.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.