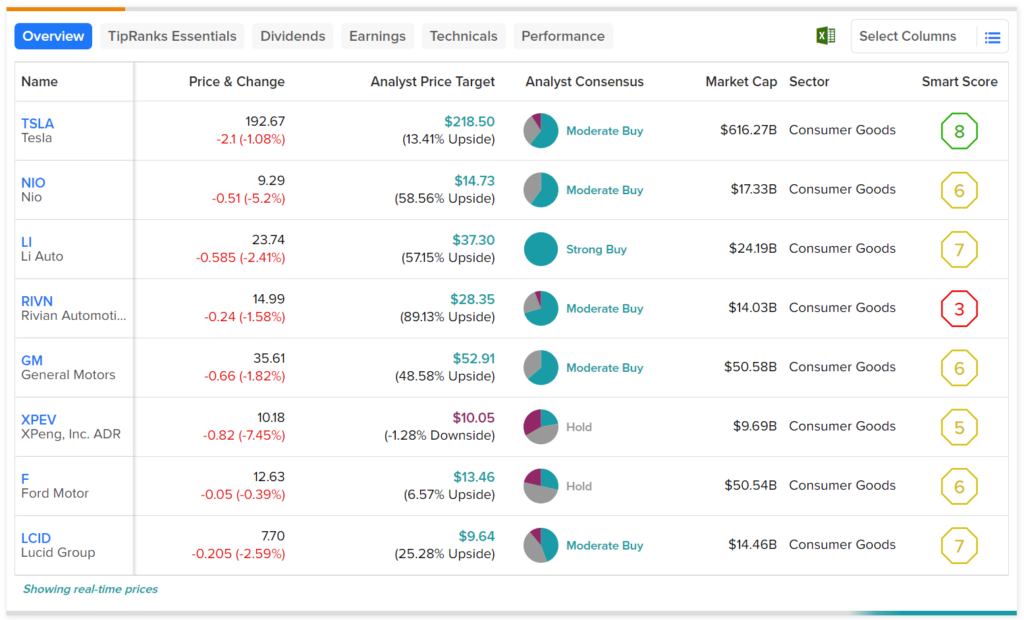

It hasn’t been a great start to the week for stocks in the EV sector. Indeed, yesterday’s downward momentum continued into today’s trading session as the major names continue to get hammered, with Chinese EV stocks getting the worst of it. This includes:

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

EV investors appear to be worried about a few things. To begin with, Tesla’s (TSLA) pricing war will pressure the entire industry, especially those that are not profitable. In addition, Tesla’s delivery numbers indicate that demand may be waning, and further price cuts could be coming in order to boost demand.

Overall, XPEV stock is getting hit the hardest in today’s trading session, as it’s down 7.45% at the time of writing. Interestingly, it’s also the stock with the lowest expectations from analysts. In fact, Wall Street rates it as a Hold with a price target of $10.05 per share, which is below its current market price. Conversely, analysts expect the most out of Rivian stock (RIVN), implying over 89% upside potential thanks to a $28.35 price target.