Etsy (NASDAQ:ETSY) may be considered little more than a highly niche version of eBay (NASDAQ:EBAY), but it does indeed fill a niche and fill it pretty well. This handicrafts-heavy corner of the e-commerce world has offered some impressive notions before. Still, a slumping economy is hitting it hard. Hard enough, in fact, that it’s just decimated its workforce. And then some. The move panicked investors, who fled for the hills and took around 5% of Etsy’s market cap with them.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Etsy showed around 11% of its workforce—roughly 225 employees in all—the door, with CEO Josh Silverman offering oddly upbeat tidbits of news ahead of their departure. Etsy, he noted, has more than doubled in size just in the last four years. It’s not surprising, especially given that 2020 gave handicrafts practitioners time like they never had before to develop and bring their wares to market. It also gave shoppers disposable income like never before.

Now, with the time lost to return-to-office mandates and the money lost to soaring inflation, Etsy is getting hit hard. Oddly, though, Etsy also revised its guidance, going from an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rate of 26% – 27% to 27% – 28% instead.

Etsy is a Victim of Its Own Success

As it turns out, Etsy’s success in recent years has not gone unnoticed, particularly from potential competitors looking for a slice of that pie. Companies like Shein and Temu Mounts have worked to get in on Etsy’s market, and the result has featured some unexpected hiccups. For instance, one customer bought a custom shirt on Etsy. But a little detective work—a quick look under the tag—revealed that the shirt was actually from Shein, complete with a Shein label. Etsy’s merchandise sales growth, meanwhile, has also proven disappointing. There’s been a rebound from the losses seen between 2021 and 2022’s third quarter, but it’s still under the high-water mark of 2021.

Is Etsy a Good Stock to Buy Today?

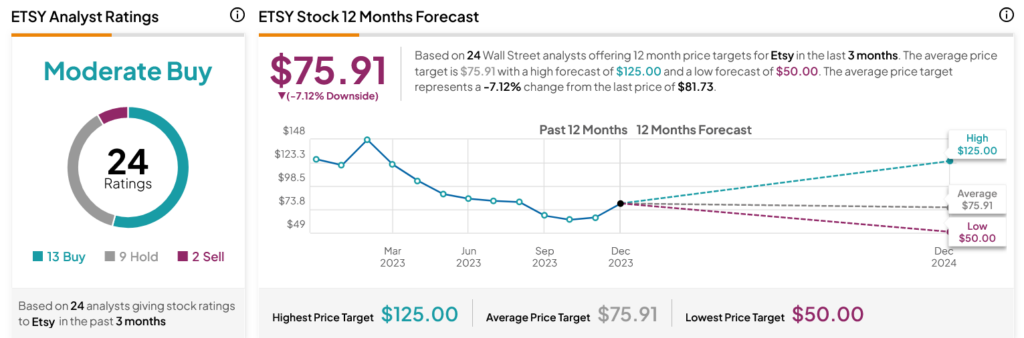

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ETSY stock based on 13 Buys, nine Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 38.34% loss in its share price over the past year, the average ETSY price target of $75.91 per share implies 7.12% downside risk.