Can you imagine a stock that would do well in both boom and bust? A stock that doesn’t care what the macroeconomic picture looks like because it could still win in either case? And can you imagine that stock ever being e-retailer Etsy (NASDAQ:ETSY)? That’s just what a report from Wolfe Research had to say, and it put Etsy up over 2.5% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wolfe researchers upgraded shares from “peer perform” to “outperform,” and also established a price target of $100 on said shares. Essentially, Wolfe researchers believe that the stock has “underperformed” thanks to a combination of factors, including multiple compression and revisions in top-line growth. In addition, Wolfe researchers noted that Etsy should ultimately prove to be a success regardless of economic conditions. Though said researchers did note that Etsy’s overall growth would be “…highly sensitive to macro conditions,” it still ultimately looked for improvements no matter what the picture looked like.

How is that possible? All Etsy has to do, Wolfe researchers noted, is modify their overall strategy—particularly marketing—according to conditions on the ground. If the macro picture improves in 2024, then Etsy should get a natural boost accordingly. If that improvement doesn’t manifest, meanwhile, all Etsy need do is pivot and put its focus on cost savings. After all, the things on Etsy tend to run a bit cheaper but, in many cases, serve the same purpose. Wolfe researchers also noted that Etsy could quickly cut costs by reducing headcount, which is up from its pre-pandemic levels.

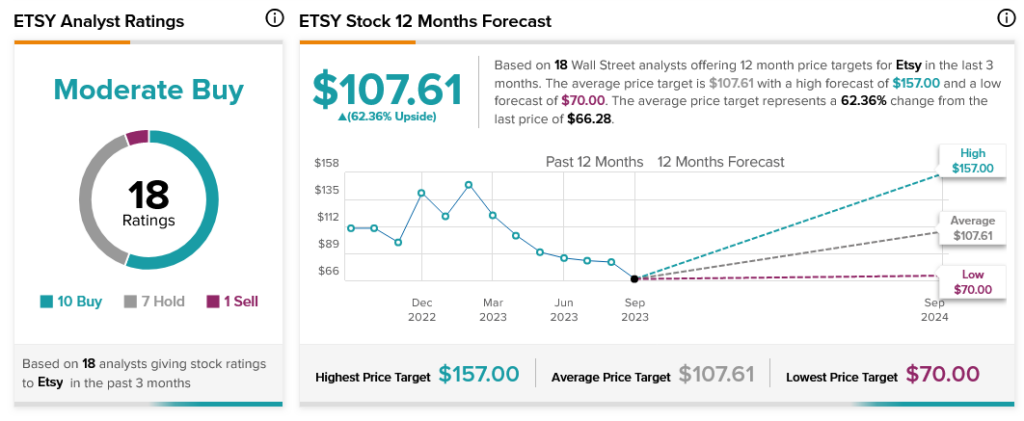

Overall, with 10 Buy ratings, seven Holds, and one Sell, analyst consensus calls Etsy stock a Moderate Buy. Further, Etsy stock offers investors a hefty 62.36% upside potential due to its average price target of $107.61.