For oil stock Equitrans Midstream (NYSE:ETRN), it started Tuesday down, and it didn’t make much of a comeback as the trading session continued. The problem? The Fourth U.S. Circuit Court shut down a construction project Equitrans was already engaged in and left the entire operation high and dry. For now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Equitrans was running a pipeline through the Jefferson National Forest in Virginia, a move which, under normal circumstances, is sure to generate controversy. The Mountain Valley Pipeline, as it’s known, got its construction halted by a three-judge panel of the Court of Appeals, who issued its verdict but offered no explanation as to why the project was suddenly shut down. Equitrans plans to respond in as grand a style as is necessary, up to and including an emergency filing with the U.S. Supreme Court itself.

While the court offered no explanation, one issue seems to be the main trigger; Congress actually passed a law that allowed the Mountain Valley Pipeline to go in in the first place. However, the appeals court is currently considering the argument that Congress actually went too far in establishing such a law, to begin with. Equitrans noted that, without some kind of intervention to reverse the court’s stay on construction, its original projection of a completed pipeline by the end of 2023 would be “jeopardize(d).”

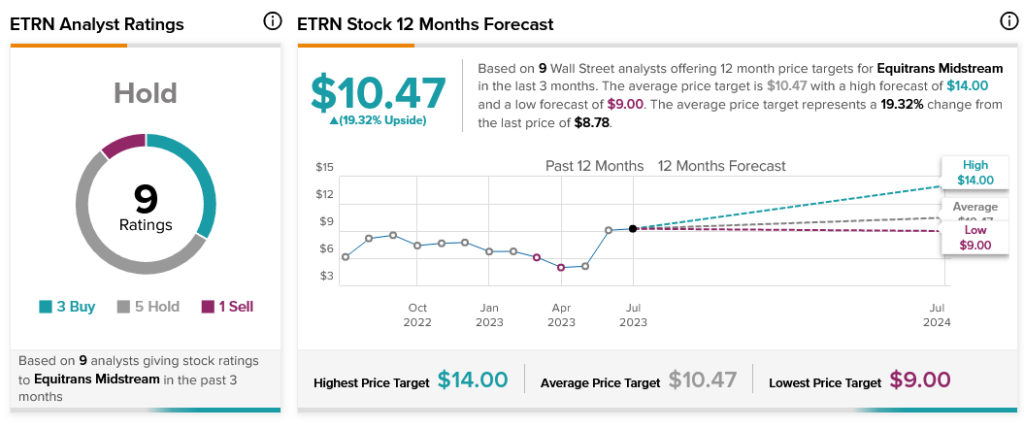

Analysts aren’t holding out a lot of hope for Equitrans Midstream stock either. Currently, Wall Street consensus calls it a Hold, with three Buy ratings, five Holds, and one Sell comprising that Hold. However, investors can get in on a decent 19.32% upside potential thanks to Equitrans Midstream stock’s average price target of $10.47.