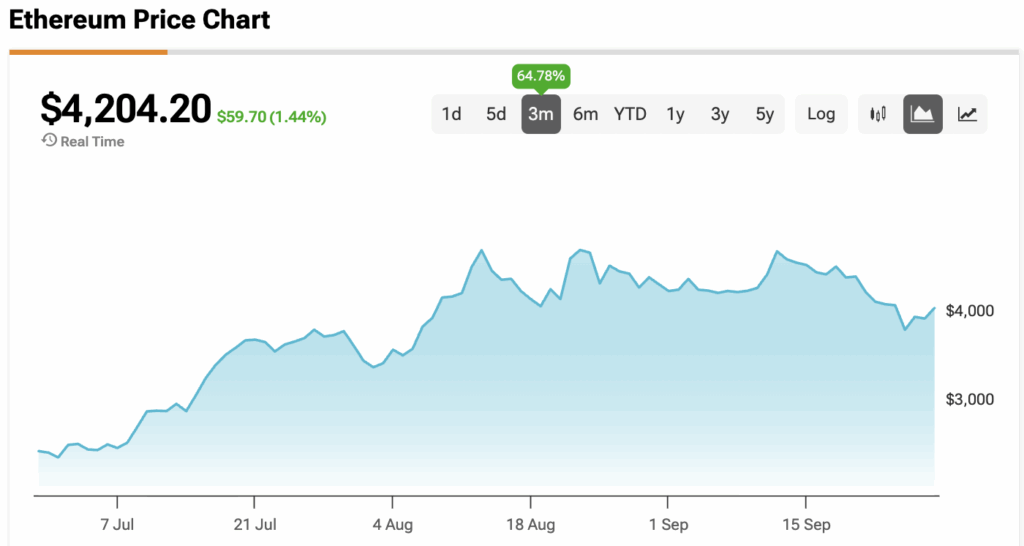

Ethereum (ETH-USD) jumped back above $4,000 to start the week, sparking hopes of a renewed bull run in October. Traders point to falling exchange supply, surging decentralized exchange (DEX) volumes, and strong seasonal data as reasons the rally may have more room to run.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ETH Supply Faces Historic Decline on Exchanges

Ethereum climbed 3.5% over the past 24 hours, retesting the $4,200 zone. Onchain data shows exchange reserves at their lowest levels since 2016, signaling growing accumulation.

CryptoQuant analyst CryptoMe flagged three drivers behind the drain: investors moving ETH into self-custody, staking activity, and wallet transfers. Exchange outflows are now comparable to levels seen at the height of the 2022 bear market.

“Is ETH about to boom?” CryptoMe asked in a weekend note. “When demand triggers, the rally starts. Falling reserves prepare the ground for that rally.”

Ethereum DEX Activity Climbs 47%

The rally coincides with renewed activity on Ethereum-based DEXs. Weekly volumes jumped 47% to $33.9 billion, according to DefiLlama, with Maverick Protocol and Uniswap seeing the biggest gains.

Ethereum competitors lagged. Solana’s (SOL-USD) DEX activity rose just 6% and BNB’s (BNB-USD) climbed 8.3% over the same period.

Historically, spikes in Ethereum DEX volumes have foreshadowed price rallies. In summer 2024, ETH nearly doubled as weekly DEX activity surged to $40 billion.

ETH Price Is Poised for an October “Pump”

ETH shed 6% in September, matching seasonal trends. But October tells a different story: CoinGlass data shows Ethereum averages 4.77% monthly gains, which would imply a move toward $4,300.

“Ethereum monthly returns show a clear pattern that October and beyond is a bullish season,” crypto analyst Marzell wrote on X. “October is often the ignition… get ready for the Q4 $ETH pump!”

Analyst Midas agreed, pointing to parallels with 2020. “ETH is repeating the same Q3 2020 pattern,” he posted, noting that the setup was followed by a more than 100% rally into year-end.

At the time of writing, Ethereum is sitting at $4,204.20.