Estée Lauder (NYSE:EL) shares jumped by nearly 17% in the early session today after the beauty products provider delivered a better-than-anticipated set of second-quarter numbers. Despite a year-over-year decline of 7.4%, revenue of $4.28 billion exceeded expectations by $87 million. Further, EPS of $0.88 outpaced estimates by a wide margin of $0.34. The company also announced a headcount reduction as part of its restructuring efforts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, organic net sales declined by 8% due to challenges in Asia travel retail and persistent softness in the prestige beauty category in China. On the other hand, Estée Lauder witnessed net sales gains in Asia/Pacific, the Middle East & Africa, and major markets in Latin America. Still, net sales in the Skin Care and Makeup verticals witnessed declines of 10% and 8%, respectively. Meanwhile, net sales in the Fragrance vertical remained essentially flat.

In Q2, Estée Lauder focused its efforts on lowering inventory in Asia travel retail, improving working capital, and driving efficiency. The company is expanding its Profit Recovery plan to include a restructuring program. The efforts, which include a net headcount reduction of 3% to 5%, are expected to drive gains in Fiscal Years 2025 and 2026.

With these initiatives, Estée Lauder aims to return to double-digit growth in organic net sales in the second half of Fiscal Year 2024. For Q3, net sales are seen rising by 3% to 5%, with EPS landing between $0.36 and $0.46. For the full year, the company expects net sales growth of -1% to 1%. EPS is seen hovering between $2.08 and $2.23.

Is EL a Good Stock to Buy?

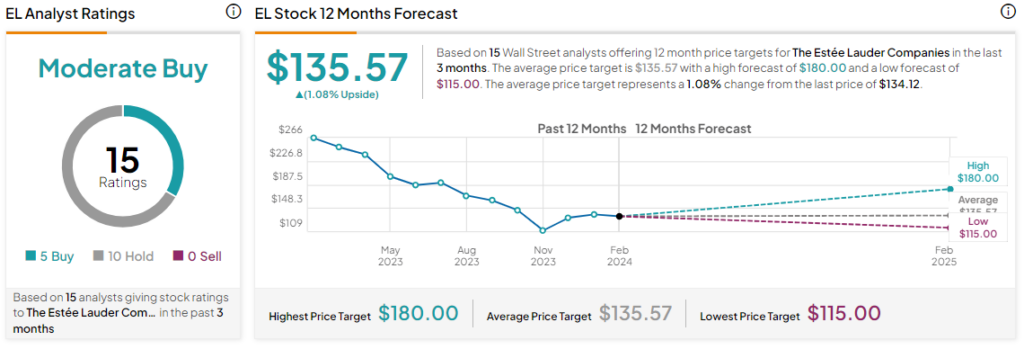

Overall, the Street has a Moderate Buy consensus rating on Estée Lauder, and the average EL price target of $135.57 implies the stock may be hovering at fair valuation levels at present. That’s after a nearly 50% decline in the company’s share price over the past year.

Read full Disclosure