Shares of The Estée Lauder Companies (NYSE: EL) plunged in pre-market trading after the cosmetics company lowered its outlook as it expects headwinds to continue in China. The company now anticipates FY24 sales to range between a decline of 2% and an increase of 1%. Estée Lauder’s prior forecast had projected sales to rise between 5% and 7% year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company anticipates adjusted diluted earnings per share to decline between 33% and 25% year-over-year on a constant currency basis in FY24 with diluted earnings likely to be in the range of $2.17 to $2.42 per share. This is a decline from its prior forecast between $3.50 and $3.75 a share.

Fabrizio Freda, President and CEO explained the reason for the lowered outlook, “While we had a better-than-expected first quarter, we are lowering our fiscal 2024 outlook given incremental external headwinds, namely from the slower growth in overall prestige beauty in Asia travel retail and in mainland China…and the risks of business disruption in Israel and other parts of the Middle East.”

In Fiscal second quarter, Estée Lauder has forecasted net sales to decline between 11% and 9% year-over-year with adjusted diluted earnings likely to be in the range of $0.48 to $0.58 per share, indicating a drop of 66% to 60% year-over-year.

The company reported first quarter FY24 adjusted earnings of $0.11 per share, a fall of 92% year-over-year, while analysts were expecting a loss of $0.2 per share. Sales decreased by 10% year-over-year to $3.93 billion and were above analysts’ expectations of $3.5 billion.

Is EL Stock a Buy?

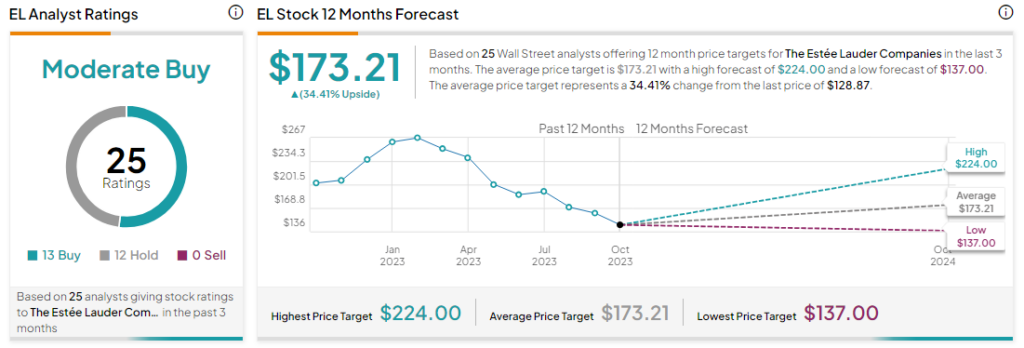

Analysts are cautiously optimistic about EL stock with a Moderate Buy consensus rating based on 13 Buys and 12 Holds. The average EL price target of $173.21 implies an upside potential of 34.4% at current levels.