They say that poise is one of the highest forms of beauty, and for beauty products maker Estee Lauder (NYSE:EL), they sure proved as much today. Estee Lauder took a bit of a pan from analysts, but despite that, it still managed to gain over 2% in Wednesday afternoon’s trading.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

TD Cowen, by way of analyst Oliver Chen, lowered Estee Lauder from Outperform to Market Perform and, with that, also cut its price target from $126 to $120. The biggest reason was “near-term risks,” particularly China’s increasing market softness and surging youth unemployment, as well as other macroeconomic issues that might weigh heavily on a cosmetics operation. Chen noted that, in order to really turn things around, Estee Lauder needed two big points: one, “…a more agile supply chain” and two, “…accelerated innovation to younger U.S. consumers.”

These are valid concerns, particularly in light of the fact that Estee Lauder stock hit a six-year low just less than a week ago today. And why? Because of, among other things, increasing softness in the Asian market. This makes Chen’s concerns particularly valid; that Asian softness has already hit Estee Lauder’s share price once. The notion that it could do so again is valid enough, and there’s very little to suggest that the Asian market is recovering. With Asia accounting for around 30% of Estee Lauder’s sales, that’s clearly a bigger potential issue than some might expect.

Is Estee Lauder a Buy or Sell?

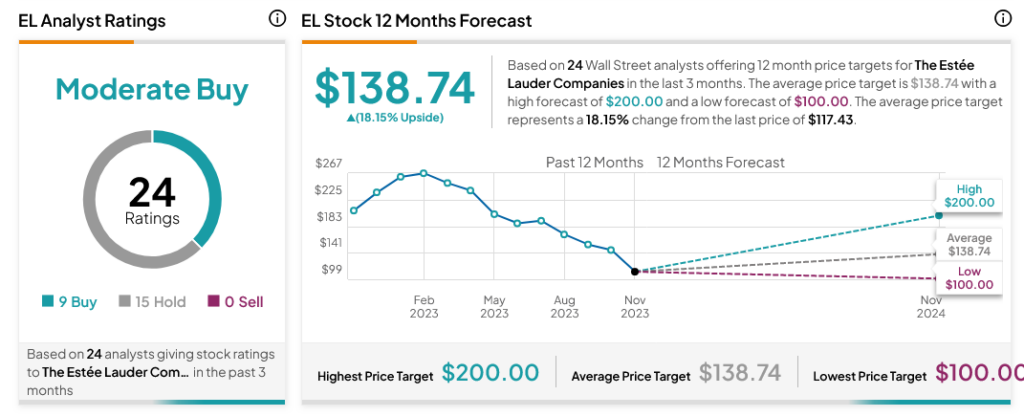

Turning to Wall Street, analysts have a Moderate Buy consensus rating on EL stock based on nine Buys and 15 Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average EL price target of $138.74 per share implies 18.15% upside potential.