For a while, things were looking up for Estee Lauder (NYSE:EL). With good reason, too; people were going out again, offices were reopening—sort of—and even China was abandoning its Zero-COVID policies in favor of something that wouldn’t turn the economy into a blistered hellscape. Despite this, Estee Lauder plunged over 15% at the time of writing, and it’s all because recovery did not go as planned.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Estee Lauder offered a dire picture going forward. Net sales for the 2023 fiscal year were previously expected to be down between 5% and 7% year-over-year. Bad news by itself, but it only got worse when Estee Lauder upped the rate of decline. Now, the expected shortfall will be between 10% and 12%, a near-doubling of the previous rate. Further, full-year EPS will also drop, going from between $4.87 and $5.02 to between $3.29 and $3.39.

What caused such a plummet? Several factors came immediately to mind, but in this case, the winner was Asia and retail travel therein. Both South Korea and the Hainan province in China saw sluggish tourism, which meant lower sales for the cosmetics retailer. Fabrizio Freda, Estee Lauder’s President and CEO, noted that the “shape of recovery” in Asian travel was looking “…far more volatile than we expected and more gradual relative to what we experienced in other regions.”

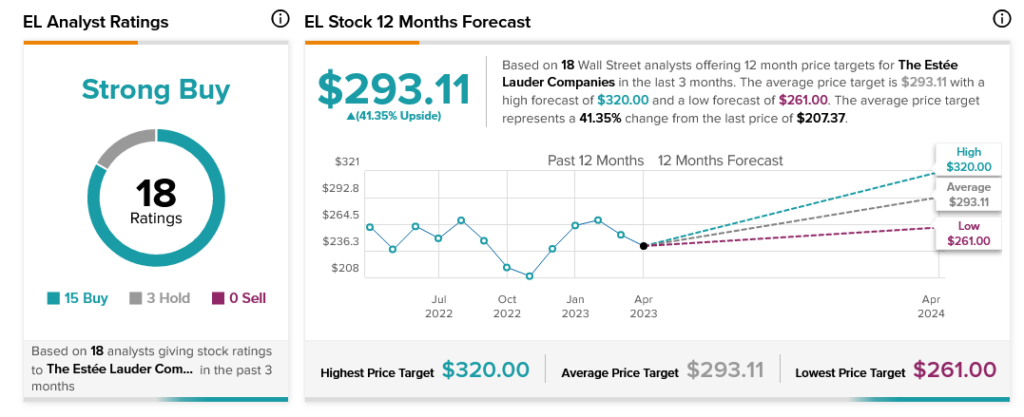

Despite this, analysts are mostly bullish on Estee Lauder. With Buy ratings outstripping Holds by five to one and no Sell ratings, Estee Lauder stock is considered a Strong Buy. Plus, it offers investors 41.35% upside potential thanks to its average price target of $293.11.